After spending the better part of the past couple weeks grazing at the menu of #DeFi options — why are they all seemingly named after food? — we decided to conduct another experiment. Here’s a plus/minus analysis of three of them: $SUSHI, $SHRIMP, and $KIMCHI. Hungry for more knowledge and really stupid food puns? Time to dig in.

$SUSHI: High Potential Platform

One of the most compelling reasons to check out Sushi is its head-on challenge to Uniswap. Let’s say you’re one of the OG LPs in DeFi — “Original Gangster Liquidity Providers in Decentralized Finance” — and you want to maximize the fees you collect from providing liquidity. Uniswap had you covered until it was forked — or, more accurately, copied — and Sushi was born, but with a twist.

The folks at Decrypt explain what happened much better than I can; suffice it to say Uniswap offered few benefits other than the trading fees, so Sushi stepped in.

All this backdrop — and the back-and-forth between the creator and the community, culminating in the appearance of shady backroom deals and the payback of $14m in ETH — doesn’t impact our experiment too much, though; we’re in it for the APY and the possibility of decent passive income.

Our Experiment: A Few Hundred Bucks and a $SUSHI/ETH Pool

In order to invest, we followed this process:

- Take $ETH and go to Uniswap*

- Find $SUSHI by adding the Sushi token on Uniswap, which we needed to do by copying and pasting the contract address; you can find it at this link: Sushi Swap Contract.

- Swap the $ETH for $SUSHI (this is where you actually buy it) but leave enough $ETH to both pool with the Sushi AND pay for gas fees (at the time, we were paying $5 or so a transaction).

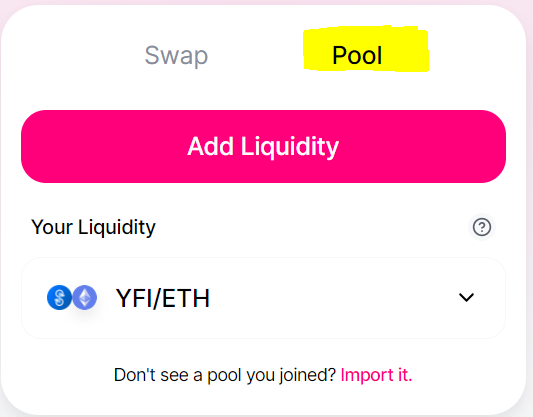

- Now, do that “Pool Thing,” which is where you “Add Liquidity.”

* we invested using Uniswap, but now you can just go straight to Sushiswap.org and click on the “Exchange” tab. This is what you’ll see.

If you follow all of these steps, you, too, can become a Liquidity Provider.

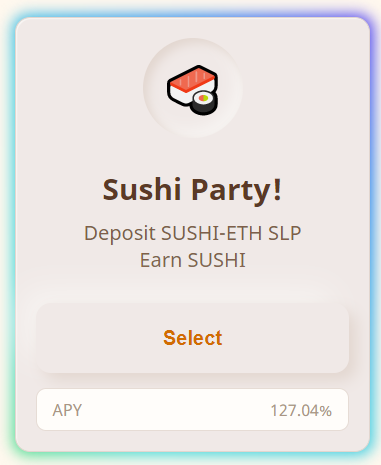

That estimated APY has come way down, actually, in the past 24 hours; we were experiencing an APY that was around 1000% up until yesterday. Here’s a screenshot from just a bit ago:

We’ll continue to watch this one; the fact that the interest thrown off so far by our holdings, in the first week, added around 8% to the value of our LP tokens is nothing to sneeze at.

So Then We Got Hungry for $SHRIMP

This one, Shrimp.finance, deserves a warning label: Votalite as Heck. You could lose everything. AND, because we still haven’t figured it out completely, it is VERY SLOW to tell you if you’ve actually gained anything.

To wit, we invested in this one and held for about 24 hours before we tried to “harvest” our earnings. When we went to harvest, nothing was there beyond our original investment.

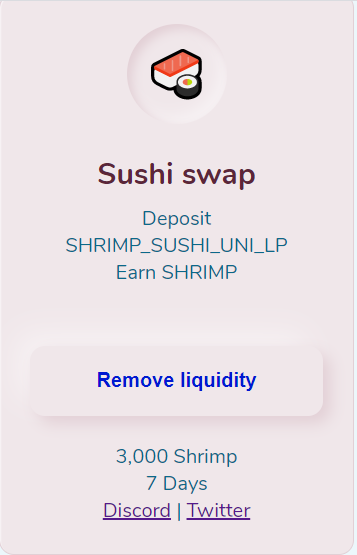

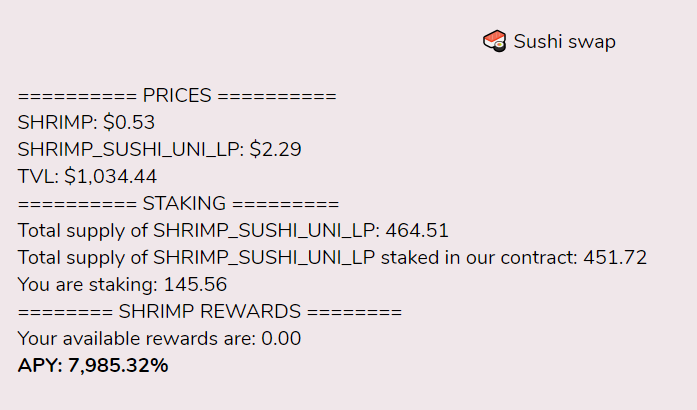

Our investment, however, is part of one of the “Advanced Pools,” screenshot below, and we believe that might mean that our investment needs to be held for 7 days before we see what our APY actually turned out to be.

Time to talk about math, too; or, time to talk about our understanding of the math involved. For instance, when we first saw this pool, the APY was estimated to be something like 300,000%. We think this was calculated by figuring out that the TVL in this pool was de minimis and the 3000 Shrimp thrown off to one user would amount to 821% interest per day (or 300,000 divided by 365).

When we got in, the interest level immediately dropped — though it was still a tidy 25,000%.

Math tells me that was on track to earn 71% a day, until someone else jumped into the pool…

It has dropped to 21% or so per day — two days after we jumped back in, so we’ll play a wait and see approach and find out when and if we’ll get the interest added, and, if our math is semi-correct, how we’ll benefit. (71 percent added each of the first two days, then 21 percent added for the next few days; we’ve promised ourselves to wait until the 18th, when it has been a week, to see how interest is credited.)

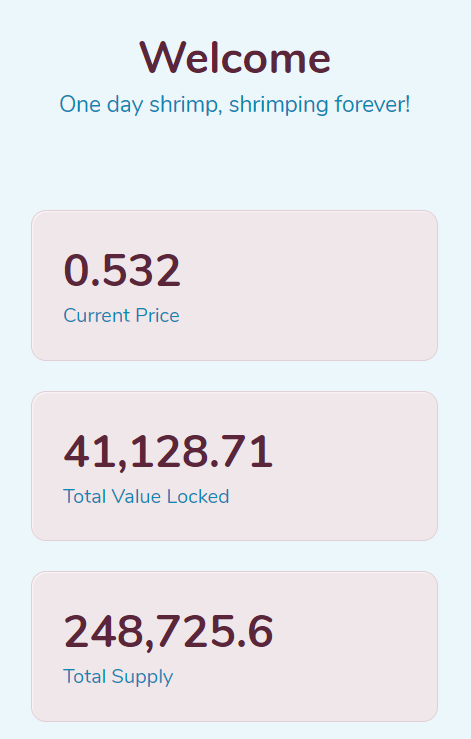

Note that the volatility also calls into question just how much money this will add up to: when Shrimp launched, on Sept. 4, its price was reported at $2.65. Its own website gives the price as of this writing at $0.516, while CoinMarketCap says it’s more like 79 cents per.

As they say, “watch this space for more.”

If You’re Really Hungry, Add $KIMCHI to Your Meal

Kimchi has the potential to be quite lucrative for us; it also has the potential to blow up completely in our faces. Time for this reminder to “DO YOUR OWN RESEARCH” and not to use any of this as investment advice.

We got into this one in part because we just needed to add one additional token to our repertoire: $KIMCHI. We could have gone with one of the other liquidity pools on the page, but, in this case, all we had to do was follow similar instructions above and use some $ETH we found under the couch cushions.

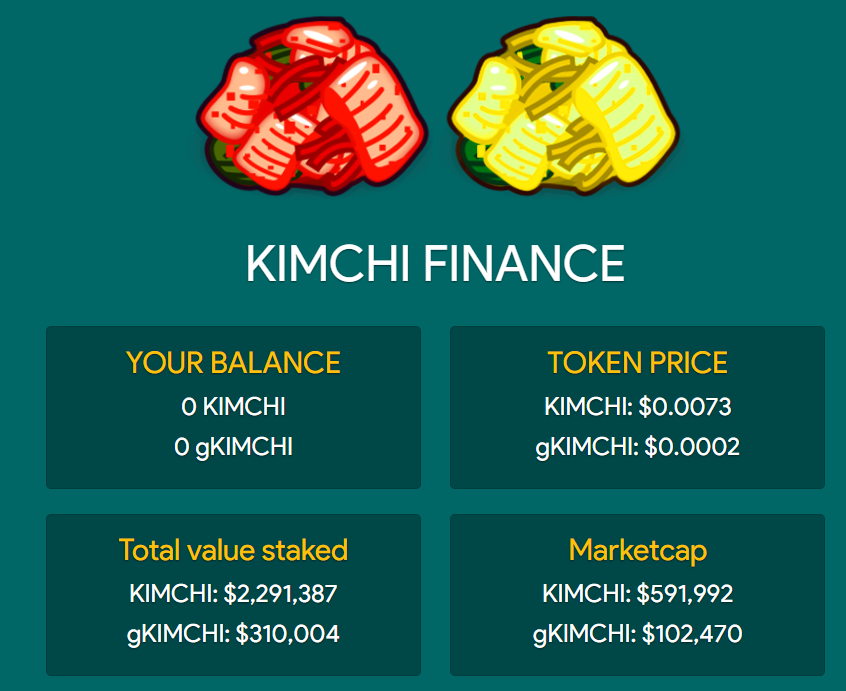

Here’s this morning’s interest rate:

After we bought the $KIMCHI and pooled it with our $ETH (on Uniswap; remains to be seen if they’ll add other platforms, especially with Sushi’s developments this past week), we ended up with around $520 worth of investment in the pool. (NOTE: Gas was expensive when we first tried this, and, even at $5 per transaction, you want to maximize how much you invest and minimize withdrawals.) Here’s what our stake looks like now.

Is it possible that we’ve already made around 6% interest on our original investment? Yes, it is entirely possible.

It’s also possible, given the low-ish “TVL” on the platform, and the sub-7-figure value of the coin itself, that this thing will continue to languish for the foreseeable future.

Or it could pop. What should the market capitalization be in relation to the total value locked? If you take $YFI as an example, the token’s market cap is north of $1 billion, but the TVL as reported by DeFi Pulse is below that. Even at a 1/1 ratio, you’re looking at a 3x growth from here in the coin’s price.

Let’s Watch This Unfold…

We’re probably best described as anxious when it comes to these platforms. Not sure what to expect, and, again, it’s an experiment. Could end up being a delicious meal, or we could have indigestion. Or worse.

Leave a Reply