First up, thanks so much for the support yesterday – our largest traffic day ever, thanks entirely to our breaking the Microhash Scam news. That serves as a reminder that we’re in the Wild Wild West, and you should tread extremely carefully with any and all of these Bitcoin and cryptocurrency-related platforms.

Interestingly, yesterday’s post on Microhash led us to the website of Bitpetite – which is a platform we signed up for a week ago – because, for a brief time, Microhash had its servers redirect to Bitpetite. Later, we’re told the servers redirected to Genesis Mining, and now you get a rather odd message that it’s down.

We have the perfect segue, we think, to talk about Bitpetite. As is usually the case, we’re going to add several AFFILIATE LINKS here, and we’ll do our best to be as blatant as we can when doing so. Like this: Bitpetite AFFILIATE LINK. So here goes.

We have the perfect segue, we think, to talk about Bitpetite. As is usually the case, we’re going to add several AFFILIATE LINKS here, and we’ll do our best to be as blatant as we can when doing so. Like this: Bitpetite AFFILIATE LINK. So here goes.

The Bitpetite Twist

As we learned on last week’s post – Passive Crypto Income – the main premise with the sites we have tried out so far goes something like this:

- You loan them your coins – Bitcoin, mostly

- They take those coins and trade them, along with others, in a variety of markets

- They make money on the volatility in the market

- You get interest that has the opportunity, under certain conditions, to compound.

In exchange for returns that range from really crazy to potentially life-changing, you sacrifice a couple of things:

- Your coins – which, let’s face it, once they’re out of your own custody, could conceivably end up anywhere

- An understanding of how exactly they do it

- Your occasional sanity (one of the sites we talked about last week, AMBIS, (that’s an AFFILIATE LINK) went down for a little while recently; today it seems to be doing something goofy with its interest payments).

At the risk of yet another list, here’s a list of what I think the Bitpetite twist on passive income includes:

- More coins: BTC, Ethereum, and Litecoin

- Pairing those coins with the USD and allowing you to earn interest in either the coin/token or US dollars

- No compounding.

How Do They Do It?

The reason there could be something long-term to this concept is because Bitpetite focuses on money transfers using the coins. Rather than a trading bot that might or might not throw off really impressive returns, Bitpetite simply pools your coins with other coins, acts as a transfer agent, and takes a cut, using the profit from the transaction fees to ensure they can pay you the interest promised.

Having recently moved quite a few BTC back and forth a few places, I know how pesky those fees can be. So this is another arbitrage play and maybe there’s a pretty good chance they can pull it off.

Our Experiment

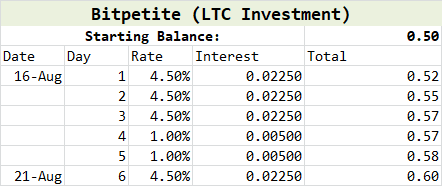

We first decided to get rolling with Bitpetite (AFFILIATE LINK) on the 16th of August. Here’s what our math told us we’d accomplish:

And…

Well, we weren’t that far off. More on that in a second, but first, a note about their bizarre interest program.

We find it a little bizarre in two ways: (1) it rotates from high during the weekdays to low on the weekends and (2) it is higher for a six-week loan than for a nine-week loan.

Yeah, that second one is goofy – 4.5% (during the week) for a six-week loan, 3.97% for a nine-week one.

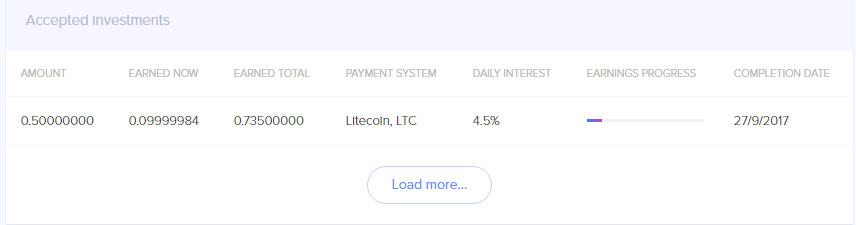

Anyway, here’s a screener of what I have right now:

Other than the fact that I might have actually funded the loan late in the day on the 16th, which accounts for the fact that August 21st was yesterday, the “Amount” plus “Earned Now” columns add up to pretty close to 0.6 LTC. So I’ll count that as a win for my mathing skills.

Multiple Hedges Possible

What I like about this is that you could, in effect, have six different loans outstanding, and hedge against an upturn in the USD – or a downturn in any of the three coins – or a subsequent moonshot of any of the three coins.

That’s right: since I chose the “Litecoin, LTC” option, when my term is done, my interest, which will have been calculated in Litecoin, will be calculated in LTC and paid out in LTC at the end of the six-week term. (That’s where “Earned Total” comes in above – that amount should actually be “What You Will Have Earned.”) I’ll have 1.235 LTC.

Today, that amount equates to $57.34 (using today’s price of $46.43), which would be a return of 168%. Or I could keep it in LTC for a while.

Should I invest in another option, I could go with the Bitcoin, USD pair, and have my BTC converted to dollars at the time of investment, my interest paid in dollars, and then, at the end of the term, have it converted all back to BTC.

Why I Pause

Again, do your own research, we’re not responsible for gains or losses, and get advice from experts on things like taxes.

I pause because the English isn’t great, and they aren’t blatant enough about the switch of interest rates between weekdays and weekends.

BUT, the fact that there’s not a compounding element does, actually, mean that I feel this is a pretty decent basket to put some eggs in.

As with all of these things, we’re conducting an experiment. It may be successful, it may fail. But we’ll keep you updated on what we find out.

Here’s that AFFILIATE LINK one more time if you’d like to check it out.

Leave a Reply