Hi there, crypto trader. How are you. Doing okay? Keeping busy in this new new new market we’re in?

Hi there, crypto trader. How are you. Doing okay? Keeping busy in this new new new market we’re in?

Oh, you panicked? Well, I understand. After all, panic is a natural reflex, especially when the sky is falling like it did for a few days.

I mean, look at this Bitcoin chart!

That’s kinda scary, right?

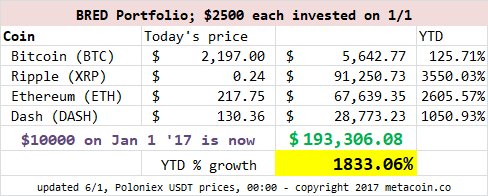

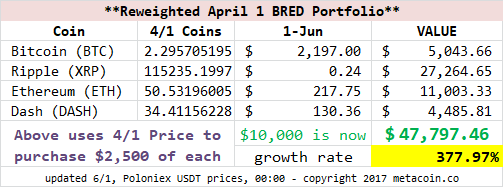

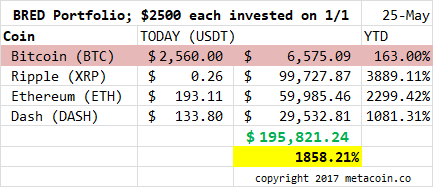

Buy The Failed Dip

Before we explain the concept, let’s look at an eerily similar chart from Ethereum.

The toughest part about Buying the Failed Dip is figuring out exactly when the dip has failed.

In fact, returning to the ETH chart above, it looks like there were four failed dips – four times where there’s a Fibonacci level that the price dropped below – and four comebacks.

The fourth appears to be happening this morning – welcome to the rapidly changing nature of cryptocurrency markets.

So…what’s the advice here?

Buy The Fundamentals, Dude

Yup. You can day trade or week trade or whatever kind of trade you want to do – that can be profitable, but you have to know what you’re doing. And, unless you are really good at following charts and seeing action, you might get burned.

Or you can Buy The Fundamentals, Dude. That’s right:

- Bitcoin is the world’s reserve cryptocurrency, or the gateway to other altcoins.

- Ethereum is the smart contract and ICO gateway.

- And so on…Ripple cointinues (see what I did there?) making inroads in the world’s banks; Dash has an awesome community; Siacoin (LONG “i”) is likely to tackle Amazon Web Services SOON.

It’s Going to Continue Being Crazy…

Stick to fundamentals.