Happy Tax Day, ‘Merica!

If you’re visiting this site from elsewhere in the world, welcome! Great to have you here. We Americans have a deadline of today to pay our Federal income taxes and boy is that fun this year. You may have heard about a tax cut last year and the ensuing OMG factor that came next: “the rich paid nothing and I don’t get a refund anymore!”

That’s not entirely true. Because of withholdings and how much some people had – or didn’t have – taken out of their paychecks, it *sounds* like lots of people had smaller refunds this tax season.

Some of you, though, may be getting a little money back. Or, in this roaring economy, you may find yourselves with cash to spend, or invest.

We’re here for ya!

What Happened to Our Other Portfolios?

Oh, you mean like BRED and the “Hedge Fund?” Well, as we spend our time getting this site back and running after the “Crypto Winter,” we plan on revisiting those, too.

For now, though, we’ve decided to give you three options: Small, Medium, and Large. DO YOUR OWN RESEARCH, this is not investment advice, and remember that you may lose a little, a lot, or ALL of your capital with anything.

Here goes.

SMALL PORTFOLIO (Like, $100-$500)…What to Do, What to Do?

TBH, we’d stay away from speculating on high-fliers. We’ve been there, it can get ugly if something goes completely belly up.

In fact, if you want to spend all of your small portfolio on crypto, here’s what we’d recommend:

First: Divide it in Half

Let’s use $500 as the number here. Take half and just put it in a Coinbase account and leave it there. You can get one of 11 currencies at Coinbase (THAT’S AN AFFILIATE LINK OVER THERE AND YOU CAN GET A BONUS AND WE GET A BONUS, TOO, WITH QUALIFYING PURCHASE) and we’d stick with Bitcoin, Ripple, and Ethereum (or just pick one) and leave it there. You’re in the game with $250 and you won’t feel the need to play around. Which brings us to the other half…

Then: Play Around

We’ve made no secret here that we’re now taking quite a deep dive into a crypto gaming community called MegaCryptoPolis. (ANOTHER AFFILIATE LINK THERE.) For this, you need Ethereum and a Metamask account to keep the two safe and in sync.

We’ve had fun so far with this game – we’re playing with house money, so to speak, as we cashed in “Airdrops” from the past couple years. If you look at your tax refund as house money, you might have some fun, too. Plus, there’s a bit of a gambling element, in that you’re taking a chance on which cool “Citizen” you’ll end up with. Here’s our favorite so far, she means business and we’ve named her “Sloan.”

MEDIUM PORTFOLIO: $1000-$5000

With this portfolio, we’d suggest you figure out how much – if any – speculation you want to do, and how much you just want to park in something (somewhat) safe.

If you’re not the play money type, then you can consider revisiting BRED: “Bitcoin, Ripple, Ethereum, and Dash.”

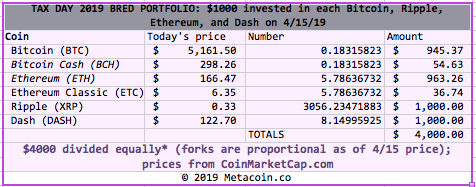

We just went back to the concept of dividing money equally between the four “core” coins of the BRED portfolio. We also considered “forks” by investing proportionally between the two forked coins; i.e. since Bitcoin’s price is roughly 19 times higher than Bitcoin Cash (BCH), we invested 19 times as much in Bitcoin.

Here’s what it looks like as of this morning:

This is also a “set it and forget it” portfolio — with the idea that you’re not going to spend way too much time looking at the price growth in any of these.

You also may not get rich off of this portfolio, either: assume that the ship has sailed on the OMG I’M RICH!!! portfolios of a few years ago, as you’re not getting in on the ground floor on XRP (the coin from Ripple, which is why it’s known as “BRED” in this portfolio) with the hopes it will go to $20,000 per.

But this would be a good, safe, crypto bet if you can afford it.

WHALE PORTFOLIO: $5,000 on up

Okay, look at the below chart of seven currencies’ “sparkline” graphs from the past seven days. Fourth from the top (nearing its high) and seventh from the top (all upside last week) look most compelling. Curious?

These two might be somewhat worthwhile to take a stab at. BCH is Roger Ver‘s Bitcoin fork – “it’s the real Bitcoin” is what he’ll tell you. BNB is Binance Coin and that’s an equally compelling Asian crypto exchange that’s always doing interesting things – such as burning its own coins, which Twitter friend @BambouClub tells you might be right around the corner.

Both of these large coins — the above chart is from the Top 7 by market cap — and both are likely to be around for a while. We’d suggest considering them as part of your WHALE PORTFOLIO (said in all caps because why not) and here’s how that *could* look (DO YOUR OWN RESEARCH!):

- 60 percent BRED

- 20 percent Large Market Cap Coins, with 10 percent each in BCH and BNB

- 20 percent on interesting use case coins — projects in which you see potential.

That third category is where you’ll have to, again, DO YOUR OWN RESEARCH; you’ll also need to rely on gut and also sort through whether they’re good blockchain projects, good crypto exchanges, good business models, or just good ideas. Or all four.

Since you’re doing 20 percent in this category, you can pick three or four and, if any one of them goes belly up, you won’t be totally rekt.

Ideas for This Part of the WHALE PORTFOLIO

Here are a few projects to check out:

BitTube (TUBE): Someone’s going to try to take on YouTube’s market dominance and do it through the blockchain. BitTube is one such player (though, honestly, PewDiePie is headed over to DLive, which is on Steemit, so maybe his name recognition gives that platform an advantage).

Storj (STORJ): Decentralized, blockchain-enabled storage is a concept that we’re sure will take off. Whether it’s Storj or someone else remains to be seen.

Quantstamp (QSP) bailed us out in the past by analyzing smart contracts. You buy some of their coin to do that and it’s a pretty seamless thing.

And Paragon (PRG) is doing the cannabis thing — fits and starts during their development but worth looking at, as they now do both a “WeWork-for-cannabis” and a “seed-to-sale” tracking platform.

UPSHOT: Your Tax Refund Can Work For You, Maybe, With Luck

We’re just here with a few ideas, that’s all. And Lord knows there are folks anxious about getting back in, and curious about whether we’ll see another bull run ever. So, again, look around, do your research, and, if you’re ready, dive in!