We’re back! Yes, that’s right, Metacoin is back, we’re re-entering the crypto and blockchain pool with both feet, and one of the things you’ve known us for is a unique view of the entire landscape. One such angle we’ve explored time and again is the concept of BRED: Bitcoin, Ripple, Ethereum, and Dash as a four-coin, equally weighted portfolio that can (maybe?) hedge against crypto craziness and economic upheaval.

Want to check it out again? Let’s go there.

BRED: A Primer

From the “woulda, shoulda, coulda” department, we posited a guess way back when that sitting tight with four coins that provided different sorts of exposure to the crypto market — specifically the combo of Bitcoin (the big kahuna), Ripple (now known as XRP, but a payment system that’s taking on SWIFT), Ethereum (that coin upon which a whole bunch of dApps are built), and Dash (a consumer-focused coin) — may very well give you the right kind of diversified portfolio to weather all sorts o’ storms.

Our first writeup about the subject was here: Meet the BRED Portfolio. And what an initial ride it was: As we learned right after the calendar turned to 2018, had you been wise enough to actually go there, to set aside equal amounts in the four coins and leave them, 2017 would have given you a 100-bagger. (Plus a 25-bagger on top of that.)

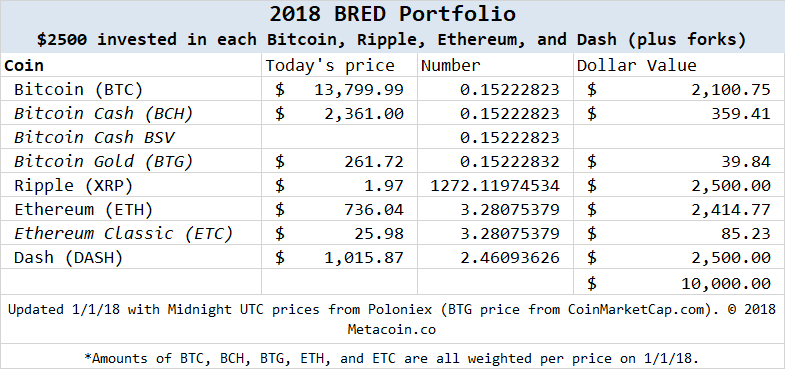

2018, found us (as detailed in the post linked to above) keeping track of two portfolios — the original BRED and the 2018 re-calibrated BRED portfolio.

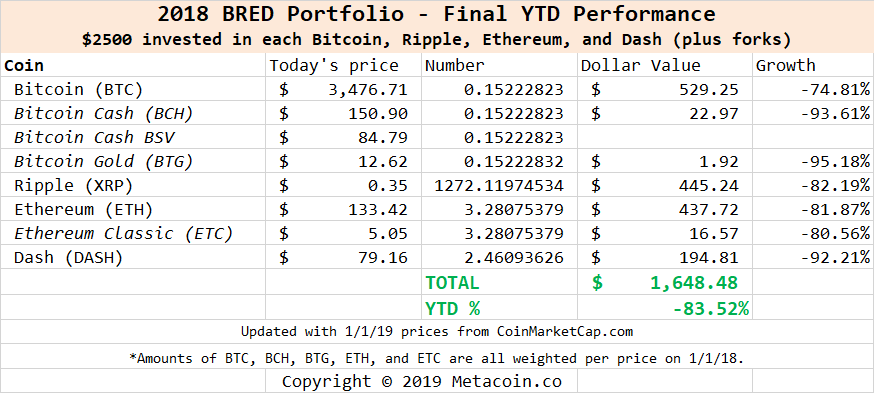

2018, as it were, would have been a much different experience.

As you can see, you would have given back 83.5%. So maybe it’s best to start fresh in 2019 with a recalibrated portfolio?

(Before we do that, here’s a refresher on 2018 BRED, as it checked in on New Year’s Day:)

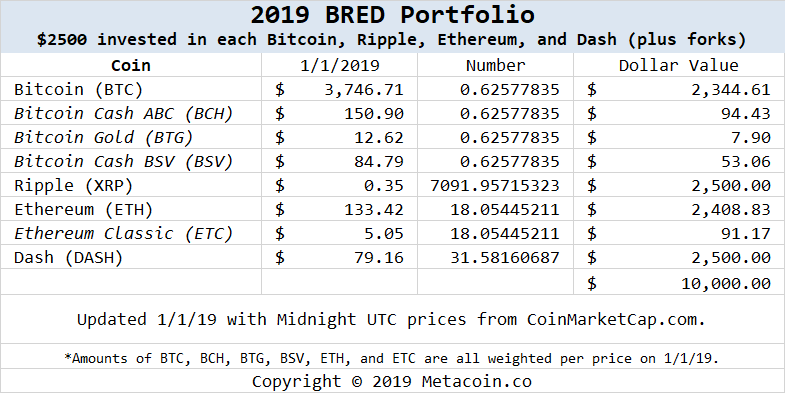

So, Let’s Move on…To 2019

If you’re looking for a headline about the 2019 BRED Portfolio, it might be something like “BITCOIN IS BACK?” with a winky smiley face and also the tears that come with having maybe gotten rekt in 2018.

But the year is not 1/3 gone and, as they say in golf, billiards, and horseshoes: “there’s a lot of green in between.” (No, they don’t say that in horseshoes, but we now got your attention.)

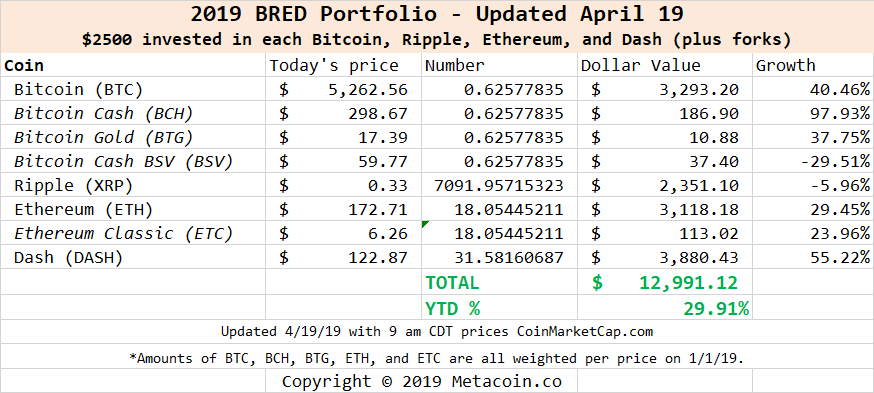

We did as we are wont to do and went back and started BRED with an allotment that matched the original 2017 rules: 1/4 of each ($2,500) in each of four core coins. You can see how we allotted the money here:

Let’s Go to the Videotape

One thing that jumps out in the sober light of day: 30 percent (almost) in returns after 3 1/2 months should cause most people to jump for joy. Maybe it’s a sign of things to come? (Actually, it’s a nice bull market performance, since any asset class that appreciates at a 30 percent clip could call it a win for the year.)

Does this mean “Sell in May and Go Away?” Well, we’re not sure. Which is partly what makes this so interesting.

HODLers will tell you that the best is yet to come for all of these coins. Those with BCH that bought at the beginning of the year have almost doubled their money. Dash is up 55 percent. And so on, and so forth…with only the questionable BSV (read more below) and the Ripple’s XRP coin having pulled back this year.

Macroeconomic headwinds could cause folks to head back to the crypto asset class, too — something to keep an eye on.

DYOR — As Always — And HODL?

We’ve stressed this over and over here on the site: Do Your Own Research. BRED could be a great portfolio again — it may be a great portfolio now — or it could go belly up and we’ll all be left wondering “what if?” as a new crypto Winter emerges.

In any event, we’ll keep tracking this, with an eye toward sharing ideas that can potentially help you.

Wait One Second Before You Go:

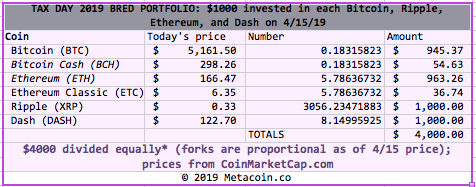

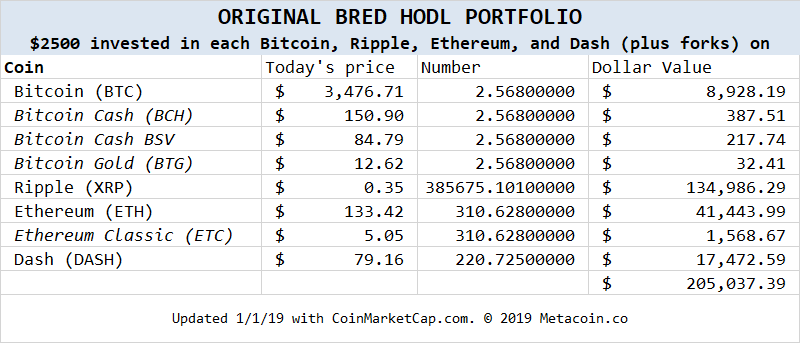

What about the original portfolio, the one we started with in 2017?

We’ve renamed it the “BRED HODL Portfolio” and here’s what it looks like now:

What About the BCH Fork Craziness?

It’s really a goofy story, but, in brief, there was a BCH fork, some folks don’t like the people who forked the coin, and it’s being delisted right and left.

Coinbase has a great writeup on what’s happening and other exchanges are using the fork as an opportunity to add the forked coin.