We run the risk of saying “I’ll just leave this here” and, well, just leaving this here. But it deserves some context, so we won’t do that.

The Metacoin “BRED Portfolio” is on Fire

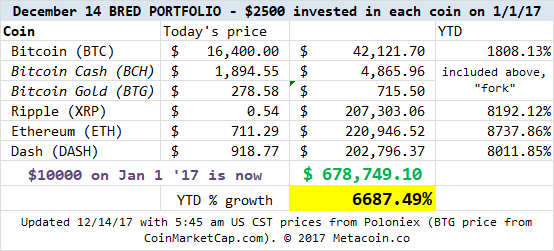

Our original post on BRED was a couple months into the year, but we decided to back-test and figure out what would have happened under the following scenario:

- Someone has an extra $10,000 sitting around;

- They divide that equally between four of the big coins: Bitcoin, Ripple, Ethereum, and Dash;

- They leave it alone.

The result is something like this:

Can Anyone Explain?

We’ll hazard a couple guesses as to what is really going on here:

- FOMO – “Fear of Missing Out” – is bringing new money off of the sidelines and into Bitcoin, especially; with a huge chunk of the Bitcoin growth during the past three months. (Bitcoin’s price was at 3400 three months ago.)

- Coinbase – which has more users than Charles Schwab. (Yes, that’s a REFERRAL LINK over there, and we’ll both get an extra $10 in BTC with a qualifying purchase if you use it.)

- Tulip Mania – since everyone’s comparing this Bitcoin and crypto bull market to the Dutch Tulip Bubble, people are acting as rationally now as they did back then.

So Then…What’s Next?

We’ll of course do a year-end wrap-up on the BRED Portfolio, and will run the numbers throughout 2018 on the original BRED, a re-calibrated BRED, and probably a couple other portfolios, too.

In the meantime, if you were wise enough to invest in these back at the beginning of the year AND hold them to now, congratulations to you.

And if not, well, you’re in the vast majority of investors.