UPDATED ON NOVEMBER 2 – Bitconnect is still cool, but we’re striking through all the text about Bitpetite, which is a scam.

UPDATED ON NOVEMBER 2 – Bitconnect is still cool, but we’re striking through all the text about Bitpetite, which is a scam.

Here on the site, we’ve talked quite a bit about the concept of “Passive Income,” and, specifically, Passive Income Platforms (PIPs) where you can invest your coins or tokens and watch them make money for you.

We’ve also tried to be as upfront and transparent as possible. This approach, we think, lets us share with you a “warts and all” look at these PIPs and whether or not they might be worth your hard-earned Bitcoins.

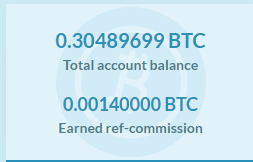

We started our journey with Bitconnect (AFFILIATE LINK), and we’ve also tried a couple duds – “scams” is actually more accurate – like Bithaul (the image over there is what they SAY we have in our account right now, though we haven’t been able to withdraw for almost a month), or Control Finance (another dead site), or Ambis (SCAM).

(The only other platform that we’ve tried and can still vouch for is Bitpetite (AFFILIATE LINK), which continues to have a great track record for us. And we promise to try more of these in the days to come, with a report on them as we proceed.) Bitpetite is a SCAM.

Bitconnect remains the leader for us because of a couple of factors:

- It is backed by an actual coin;

- That coin has a large market cap;

- There is a wide distribution, throughout the world, of Bitconnect users;

- The track record of payouts is pretty strong (see chart below).

99 Days In…

Okay, the image we’re about to share will take a little scrolling on your part. It’s a screenshot of our Excel spreadsheet that tracks the amount of interest paid each day we’ve been part of the Bitconnect system. SO it’s 99 days of history, going back to July 10, when we got started. Let’s take a look:

Before we psychoanalyze this spreadsheet, we should probably give you a refresher on the basics.

- For instance, you need to invest a minimum of $100 to get started. You need to convert Bitcoin into BCC, their coin, and then invest a round number in an increment of $10. We landed on $110 to get started because of exchange rates and whatnot on the day we invested.

- $10 is a pretty important number for the site, too, because you can only reinvest in multiples of $10.

- You are given the option to cash out your interest whenever; but we have chosen to reinvest it at each step of the way.

- Since we’re not “whales” on the site – at least not yet – our investments and reinvestments are locked down for 299 days; to get your money back sooner, you will need to invest a minimum of $1010.

We’ve tried to manage this spreadsheet so that it’s obvious to us when we reach a milestone: the “Reinvest” column is highlighted when we reinvest into the system. Another key milestone for us was September 14: that’s the date we took some affiliate commissions from Bitpetite (AFFILIATE LINK; you, too, can sign up and get affiliates on the site and get commissions should you so choose) and invested them into Bitconnect. (That’s why the upper right corner, where it says “initial investments,” reads “$310.”) (ALSO, ignore the “Today’s Total” figure; we’ll fix once the coffee consumption is at normal levels.)

Pluses and Minuses

One thing you’ll need to consider here: are you better off parking some of your coins somewhere (like Bitconnect) or just keeping them in Bitcoins and doing nothing.

This is a legitimate question – we look at our own approach as “risk management” and we aren’t planning on putting all of our eggs in any one basket. Still…

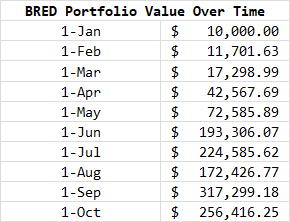

This chart shows the Bitcoin price on July 10 – the day we got started on Bitconnect – and tells us that we would have also done well had we just taken $110 worth of Bitcoin and parked it in Bitcoin. At today’s price of around $5640, that’s more than a 132% return.

BUT, if you see look at our Excel chart above, you’ll see that we did just as well, in a shorter time frame, with our original investment; $110 had turned into $260 on Sept 13, the day before we dropped another $200 into the platform.

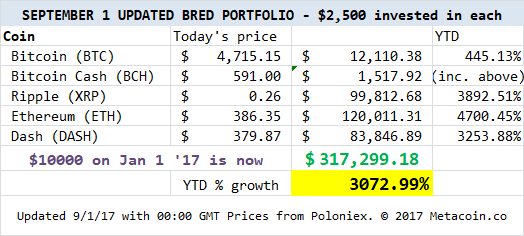

In addition to the other concerns that you should have with any Bitcoin-related investment – that you could lose your entire principal, that the site could disappear on you, that you’ll invest your time and money in something you’re better off avoiding – another concern is whether you are better off with the core coins (like our BRED Portfolio) as opposed to these passive income platforms.

This is a legitimate question – might end up being a “minus” in the grand scheme – if you take some of those Bitcoin estimates that are floating around and tease them out. For instance, one prognosticator we found on the internet made a semi-legitimate case for Bitcoin to hit $27,000 at some point in early 2018. By then, our original Bitconnect investment would be worth around $1500, but would pale in comparison to the same amount just parked in Bitcoin (which would quintuple in Q1 2018).

As Always, Watch Your Eggs

The multi-basket, disciplined approach is a good one; and there’s also something to be said for the fact that parking your Bitcoins at Bitconnect actually parks them for 299 days. It’s not like there’s a “substantial penalty for early withdrawal,” since there is, more accurately, “no possibility of early withdrawal.”

So we should summarize the same way we summarize all of our discussions of these platforms: Do Your Own Research, don’t invest more than you can afford to lose, manage your risk appropriately, and…good luck.