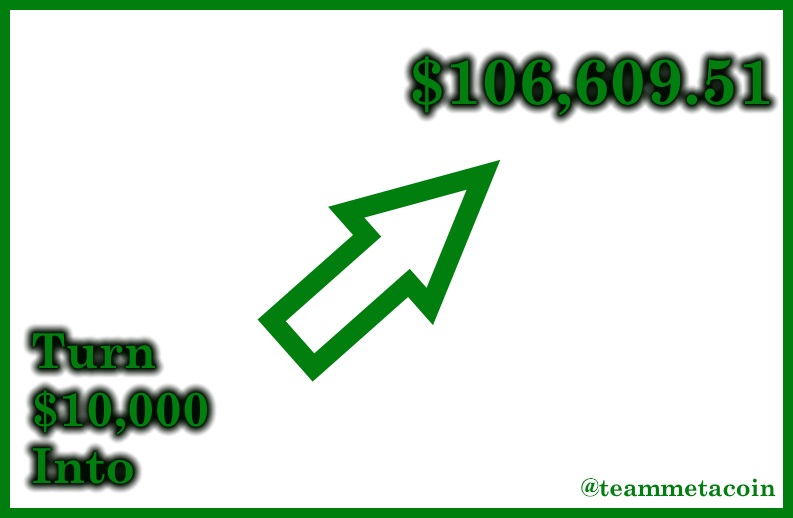

It sounds too good to be true, right? Make a small-ish investment, of only $10,000, then let it sit and ferment. After five months, sell it all and find yourself with a 19x return: something that others might wait decades for, accomplished in less than half a year.

It sounds too good to be true, right? Make a small-ish investment, of only $10,000, then let it sit and ferment. After five months, sell it all and find yourself with a 19x return: something that others might wait decades for, accomplished in less than half a year.

Welcome to the crazy world of cryptocurrency, and the even crazier concept we created called the BRED Portfolio.

If it sounds too good to be true, are we in a bubble?

Great question, and not one we’re going to answer with this post. Instead, let’s just go to the videotape and talk about exactly how this came about.

First up, in early April – so no, WE didn’t invest in our basket of cryptocurrencies on January 1 – we thought that this world needed something similar to FANG: Facebook, Amazon, Netflix, and Google. These four companies are all synonymous with some sort of internet, web, social, digital, or online business. But they also are a bit – or a LOT – different from each other.

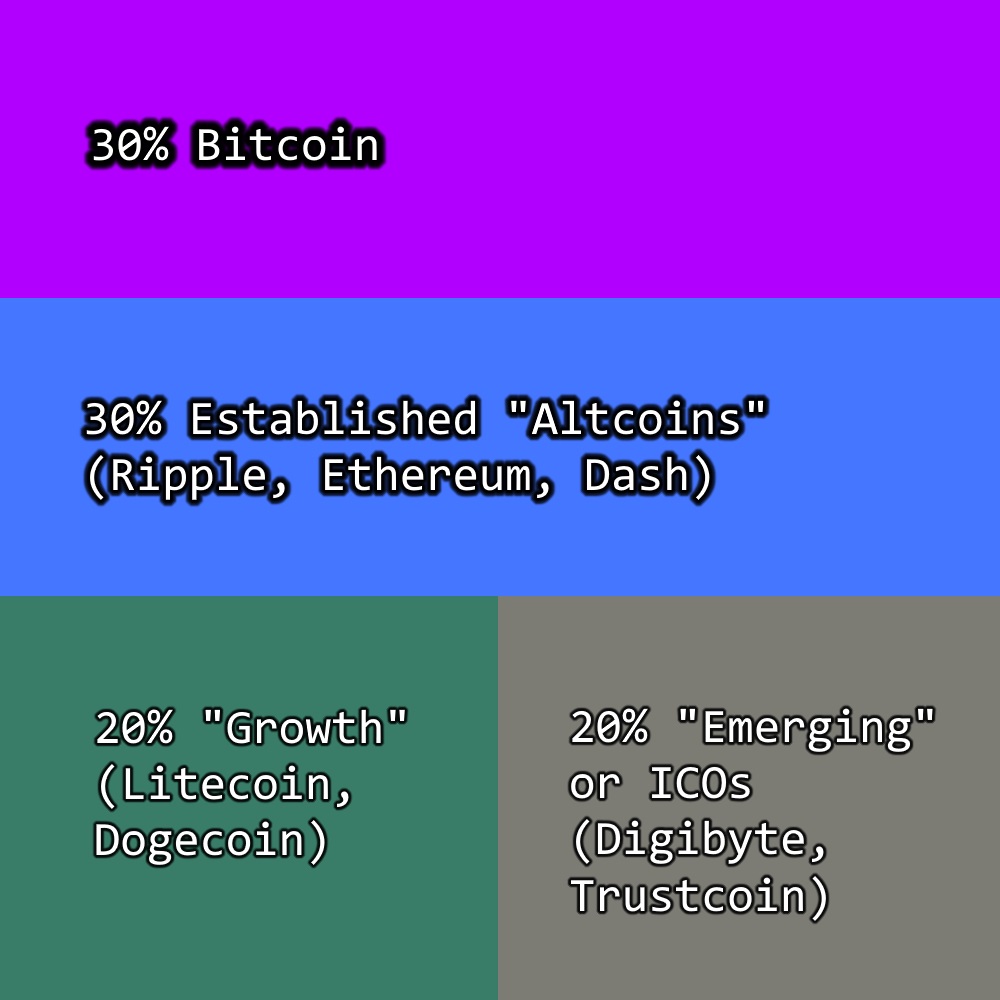

Bringing us to the BRED Portfolio. We needed a catchy acronym, but we also needed four currencies that each had a little bit of a different angle in this emerging space. Enter BRED:

- Bitcoin, the ne plus ultra of cryptocurrencies

- Ripple (ticker XRP), which is taking on SWIFT and starting to win

- Ethereum, and its smart contracts and backbone of a whole host of other launches (like Golem, for instance)

- Dash, probably the most “consumer-y” of the cryptocurrencies.

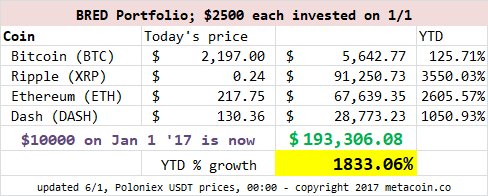

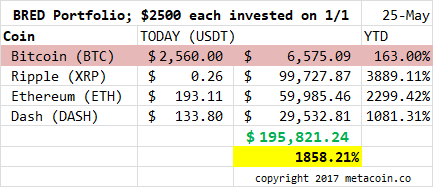

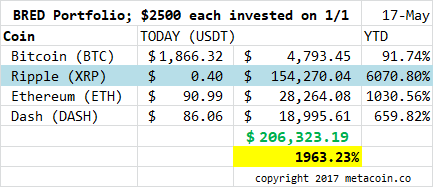

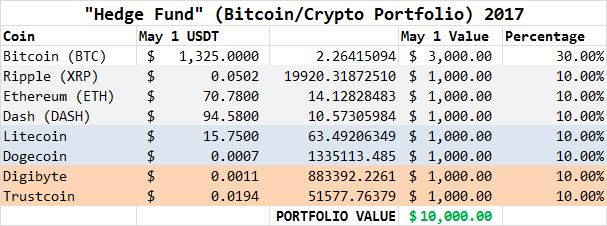

Our idea: what if you had gone back in time to January 1, bought $2500 of each of the four currencies, and left it alone. What would that portfolio look like today?

If it sounds too good to be true, you need a time machine

Here are the results:

Oh. My. Goodness.

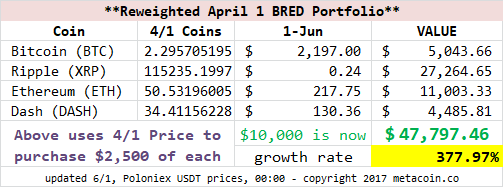

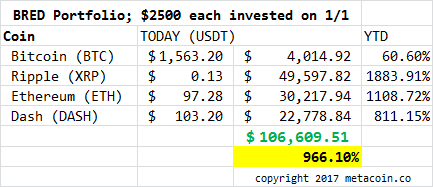

What if you waited until April 1?

We re-weighted the portfolio accordingly, buying $2,500 each of our BRED coins. The result is also quite staggering.

So now what?

You probably have a couple questions, and we’ll try to answer them.

First of all: I can’t say whether or not we’re “in a bubble.” No one knows. For each prognosticator that says there’s too much of all of these cryptocurrencies out there, there’s someone else who says that we’ve just scratched the surface.

The answer – as is normally the case in probably just about everything – is somewhere in the middle. Like the dot-com bubble of the late 90s and early 2000s, if it pops, there will be quite a few losers. There will also be a few winners: companies like Google or Amazon that kept it going and emerged and are now beyond dominant.

As for coins, whether there are too many and whether there’s too much supply of all of them: that is another good question. Ripple is a great example – to the casual observer, supply in the billions vs. an all-time capped supply number of 21 million for Bitcoin might sound like it’s a recipe for disaster for Ripple.

But, as has been discussed quite a few places, maybe Ripple is managing its entire currency plan extremely well.

There will be volatility. There will be craziness. There will be a roller coaster ride. That’s expected.

And, if you haven’t gotten started yet???

What are you waiting for? Seriously, you need to think about getting started with at least Bitcoin and/or Ethereum. You can do that by clicking on this AFFILIATE LINK for Coinbase and getting started. You can start small. But we recommend you get started.