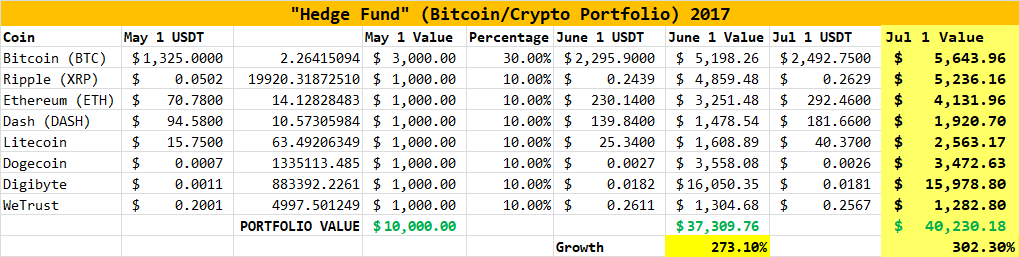

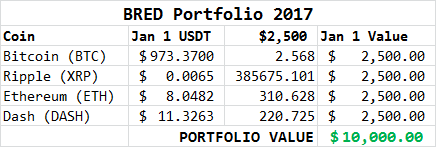

Since April, we’ve told you quite a few times about the BRED Portfolio: our own specially selected basket of currencies. Artisan, GMO-free, and tasty! Actually, no…just four of the cryptocurrencies that you would have done well with, had you invested $2,500 in each of them and left the basket alone.

Whether or not they’re the coins for hipsters or they’re the tokens of the future is beside the point: the idea here was to create an index of sorts. This basket was selected for its simple diversity:

- B – Bitcoin. The crypto that started crypto.

- R – Ripple. Their XRP token is taking on SWIFT, the international banking and money transfer protocol. (This is the closest thing to investing in a Silicon Valley startup you’ll find in cryptocurrency, as it’s an actual Silicon Valley startup.)

- E – Ethereum. The smart contract underpins so many of the ICOs that have burst onto the scene.

- D – Dash. Dare I say it still has the best community, and it is still the closest thing to a consumer-friendly cryptocurrency being used in the wild.

Before we share the updated results, a word on the fork.

Ah, the fork. The spinoff. The creation of Bitcoin Cash, which came “out of nowhere” this week and became the third-largest cryptocurrency on the planet. By market cap, at least – though, due to the nature of the beast and the system, price was all over the map and volatility was everywhere and some people have yet to find their coins.

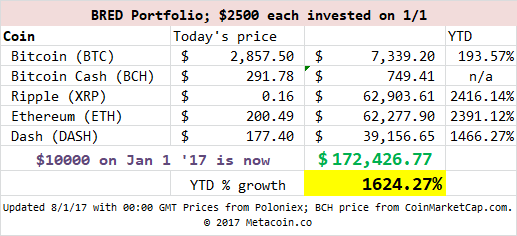

For the purposes of this portfolio, we are going to assume that we held all the keys for all of the coins. Thus, any sort of fork would have given us the same number of BCH coins as the number of BTC that we started with.

Other than that move, nothing was done to the portfolio. Nothing pulled out, nothing added in.

So, How Are We Doing?

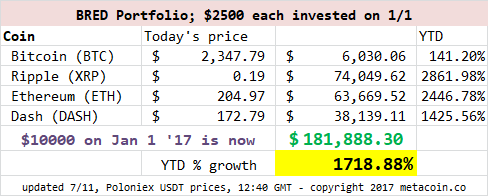

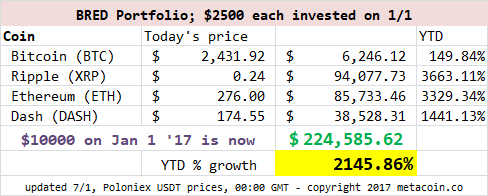

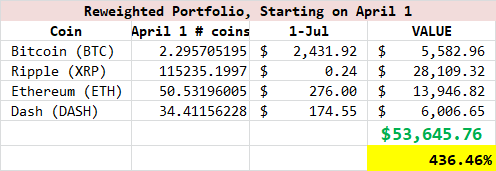

Yes, had you invested $10,000 in these four cryptocurrencies at the beginning of the year, you would have turned that basket into a rather large basket, growing it to 17 times its original size.

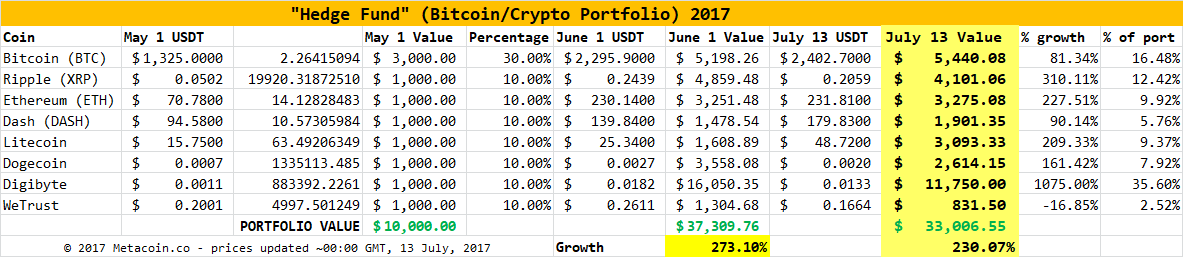

But, as you can see from that chart over there, we’re actually below the highs for the portfolio, and below even the June 1 levels.

But, as you can see from that chart over there, we’re actually below the highs for the portfolio, and below even the June 1 levels.

What gives?

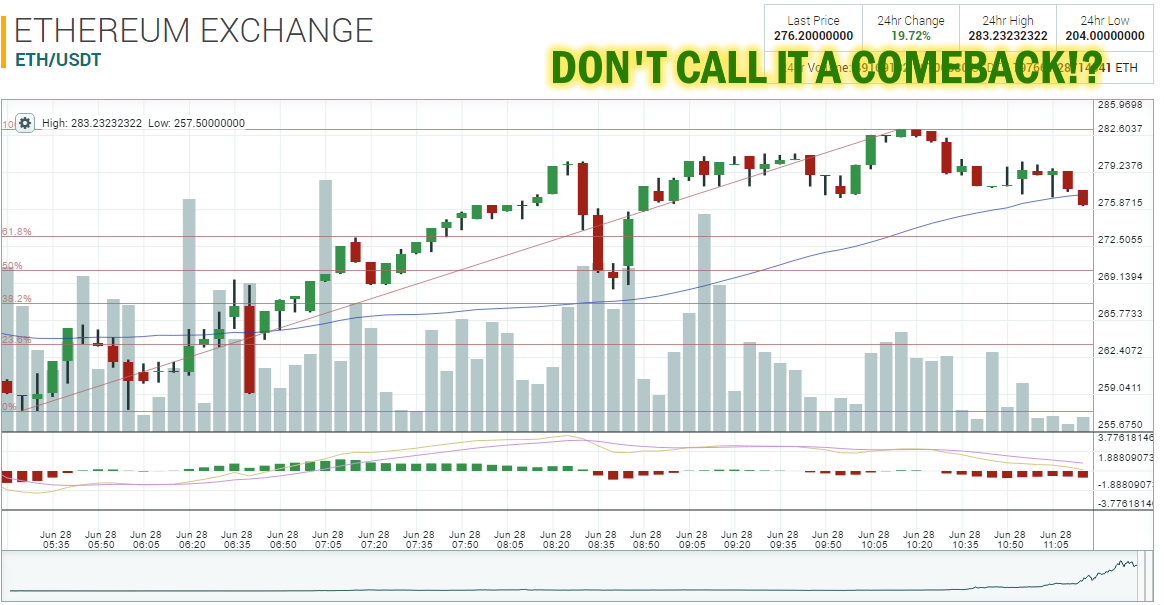

The combo of Ripple and Ethereum are both down from where they were, with each having hit all-time highs earlier this summer.

But we’re still way above the starting point – both Ripple and Ethereum took their original stakes and multiplied them 20-plus times.

The Question: Is Buy-and-Hold the Way to Go?

Only you can answer that question, and we encourage you to do your own research. And seek legal and financial advice from professionals, too.

We’re just here to share ideas and let you do what you want with them.

And one thing we did hear loud and clear this week was that different strategies to manage through “the fork” could all possibly work. Some traders we follow buckled down and held their Bitcoin and didn’t do much with it, other than wait for their Bitcoin Cash tokens to manifest themselves. Others dumped their Bitcoin and doubled down on altcoins – those cryptocurrencies that are lower on the totem pole and, in some cases, highly speculative investments.

The BRED Portfolio is likely somewhere in between – you’re holding your BTC, but you’re also holding some other coins and tokens that aren’t necessarily altcoins.

So this is one way to potentially manage through the Bitcoin and crypto universe – with a semi-diverse basket of four coins that have done pretty well this year.