We’re tooting our own horn…just a little.

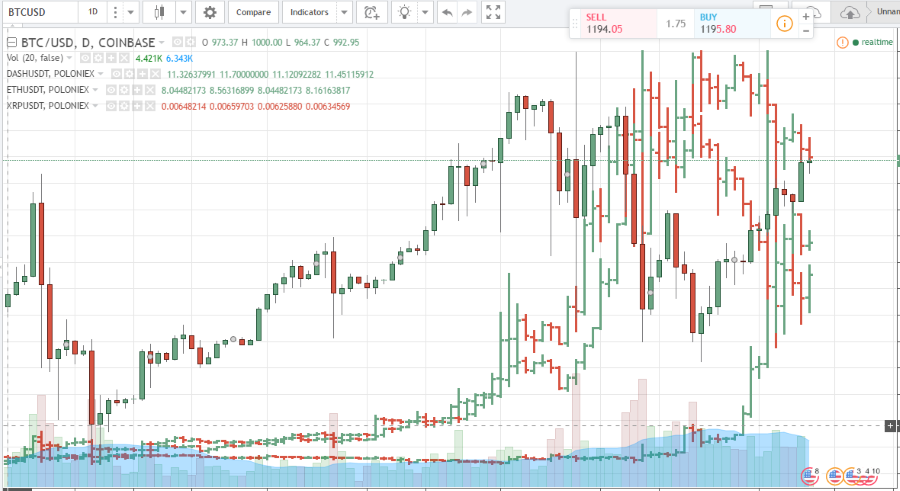

If you have followed this site for the past month (and THANK YOU for doing so), you know that we have been talking about two sides of the “coin” when it comes to cryptocurrency. One the one side, the big behemoths, led by Bitcoin, which soared to north of $1400 US this morning. (NOTE: we realize there are some…issues? questions? with Tether and the USDT price on some sites. We’re going with Poloniex’s numbers from a little before noon Central time today.) On side two: the little guys, be they altcoins or ICOs.

AND YES…there are three sides to every coin, o wise one. Side three is the edge of the coin, where many of you might currently be. Reminder to get started with Coinbase, buy some Bitcoin or Ethereum, and get rolling! They’ll give you a bonus and we’ll get a bonus for referring you.

Back to the tooting of our horn: we believe we’re onto something with the BRED portfolio.

BRED is on a TEAR

When we first came up with the concept, we picked four of the coins with the highest market cap, but also four that could fall into different buckets. The same way that Facebook, Amazon, Netflix, and Google make up FANG – with each bringing a different dish to the table – Bitcoin, Ripple, Ethereum, and Dash all have something a little different about them:

- Bitcoin – “first-mover advantage”

- Ripple – “banks are using it”

- Ethereum – “smart contract” (banks also using it)

- Dash – “most consumer-friendly”

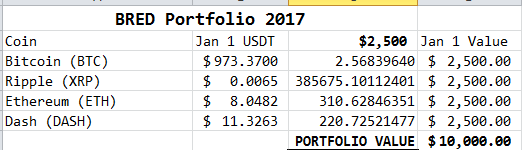

Simple enough, can fit this on a napkin. So we thought, let’s create a portfolio of just these four, give them 1/4 each of our investment, and leave it alone.

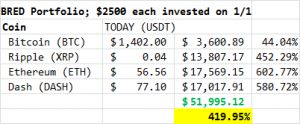

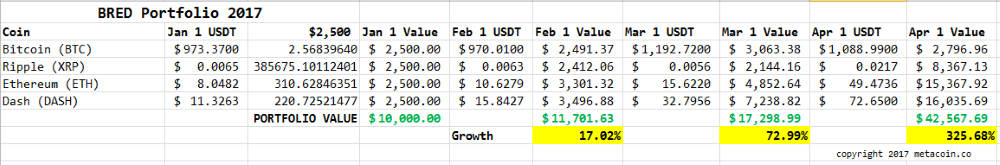

Here’s what it would look like right now:

Yes, you read that correctly. A $10,000 investment, spread equally between these four coins, made on January 1, would be worth more than $51,995.12 today.

Oh, and if you sat on the edge of the coin and waited until April 1 to buy, you’d still be up 22% THIS MONTH.

But what if you’re waiting for an ICO?

Some ICOs Had INSANE Weeks

While some of this could be the start of a bubble – and our pal Roger Aitken talks about that in this post on GNO – ICOs are on a tear, too. Well, some of them…

- GNO set records, rising to a valuation of $300m

- TaaS has raised $6.1m US, all of it outside of the US

- MobileGo has raised more than $6m in its first week

- Exscudo* stumbled a little on day one, but is nearing the $1m mark in only its second day.

* We are participating in Exscudo’s “bounty program” and have purchased a small stake. Also, we wrote about it in more detail over here.

What’s the Takeaway?

If you think things are just getting going, you may very well be right. Bitcoin’s market cap is above $20b, but, with fixed supply and companies still scrambling to get involved in blockchain technology, the four members of the BRED portfolio seem to be hitting the gas pedal.

And these four ICOs, each with their own different angle and spin, could also be poised to make serious news of their own – I mean, in addition to the news they’ve made already.

BRED or ICO?

What about both?

Only three cryptocurrencies now own a market cap of $1B (USD) or higher:

Only three cryptocurrencies now own a market cap of $1B (USD) or higher: