* “Third verse, same as the first.”

Or, put another way, we’re doing it…again…but it looks a little like previous editions and a lot like last year’s edition.

First, the Background

Going back to the inception of this site, we’ve created mock portfolios that are designed to replicate what a mutual fund or ETF would look like…if it were allowed to invest in (what we’ve called at cocktail parties) “Bitcoin and Bitcoin-like substances.”

There was the “BRED Portfolio,” our first foray into the genre. (Bonus points scored just now for using “foray” and “genre” in the same sentence.) There were previous iterations of “Growth Portfolios” (though the first was called the “Crypto Balance Portfolio”).

And there was last year’s Growth Portfolio, which…tanked. (Bear markets will do that, it appears.)

Which Brings Us to 2023

Before we start, we do need to ask a question — posed in musical format by semi-obscure British alternative act Kitchens of Distinction, circa 1992 — about “What Happens Now?”

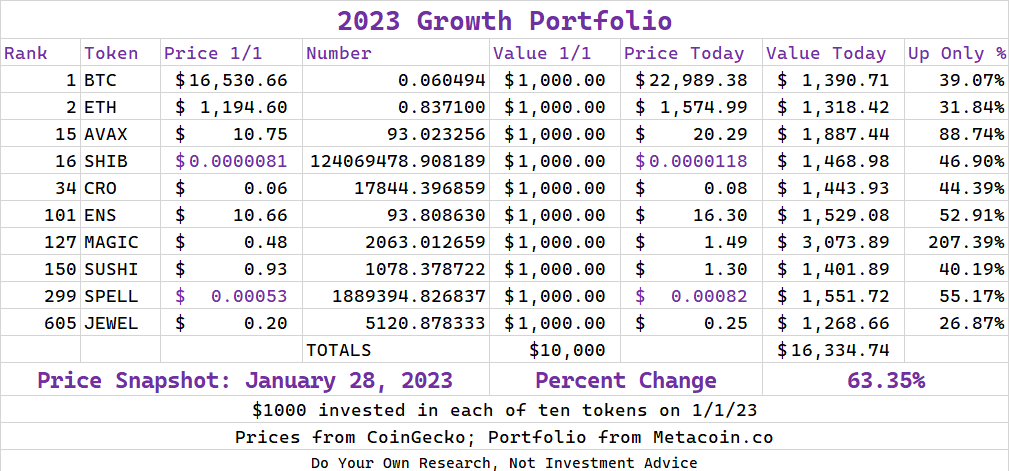

If your portfolio was, in theory, well-positioned to take advantage of a few different crypto developments — like Bitcoin’s continued dominance in the space, plus Ethereum’s “merge,” plus DeFi (like “Sushi“), and throwing in NFT gaming with coins like Magic and DeFi Kingdoms — you might as well just take the same ten coins from the previous year and rebalance on 1/1/23.

(If you want to see the 2023 Growth Portfolio in all its glory (ahem), you can also take a look at the updated numbers anytime over here: CoinGecko Link.)

Quick Thoughts

First up, this is NOT INVESTMENT ADVICE. Second, DO YOUR OWN RESEARCH.

Now that that’s out of the way…What the heck IS GOING ON???

Seriously, the “Up Only” meme phrase from last year’s bull market (before it became a bear market) over there on the one side of the image is kinda done as a joke. But not.

They’re all up! The worst performer is DeFi Kingdoms, known by its ticker of JEWEL and it’s up a measly 26.87%. Huh? MAGIC has tripled?

Well, you do realize that most of these went…way down last year. So they’re just ticking back up, trying to answer that old problem of needing to go WAY UP to make back what you lost after going WAY DOWN by (in some cases) 95% last year.

Sigh.

Final Thoughts

Again, you’re on your own with any of these portfolio ideas. You could make mad bank, you could…not.

But it does look like you could have had a nice pickup of 63% in just short of a month had you tried this 2023 Growth Portfolio.