When we stumbled upon this idea this morning, our first instinct was to play it rather cool with the headline. Something like “Introducing the BRED Portfolio: A Buy-and-Hold Bitcoin and Altcoin Investment Strategy.” And that sounds very straightforward, by the book. It’s also boring.

So we went with the clickbait headline.

Read on:

Why “BRED”?

There are a couple reasons behind this one – and it’s not just because these four letters fit together nicely. (They do, though. Props to us.)

Think about one of the best business and investment acronyms out there: FANG. Jim Cramer claims to have created the acronym several years ago, used to put four “new economy” stocks into one nice bucket. Facebook. Amazon. Netflix. Google.

It’s easy to remember, but it also includes four really solid tech stocks – and four companies that are, you could argue, doing quite a bit differently while still being in the same category.

We thought the same thing when creating this portfolio strategy: let’s get four of the biggest cryptocurrencies out there and put them in one bucket.

BUT, let’s do this with an eye toward the ones that have the best chance of long-term staying power.

While “BRED” works nicely as an acronym, these are also four coins that have managed to stick around in the crypto space.

We’re not just rationalizing…

B is for Bitcoin, and you couldn’t have a portfolio like this without Bitcoin, since it started this whole shebang, right?

R is for Ripple – which, for some reason, doesn’t have a ticker symbol that starts with “R” – and Ripple’s USDT price developments of late don’t tell the whole story; consider it the best chance of becoming the backbone of all crypto transactions throughout the world.

E is for Ethereum, whose “smart contracts” were, you could argue, the first yin to Bitcoin’s yang.

D is for Dash – “digital cash” is a very easy and consumer-friendly value proposition. We will argue that this one could win out based on the strength of its community alone.

Look at the rankings, though – if you visit Smith and Crown this morning, you’ll see that these are four of the five largest cryptocurrencies – in terms of market capitalization – in the world. In fact, going back to January 1, you would still have been picking four of the 7 largest cryptos, as shown in this chart from CoinMarketCap.com.

Argue with us if you’d like, but we’re going with this acronym. You’ll see why in a second.

Structuring the BRED Portfolio

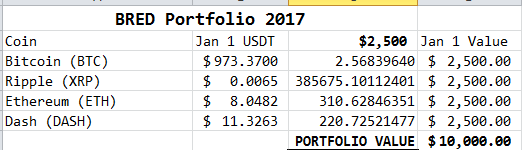

To keep it simple, we used January 1, 2017 as our starting point. And, as opposed to weighting the portfolio by market cap – which would have had Bitcoin at about 92% of the portfolio, defeating the purpose – we went with a straight 25% invested in each.

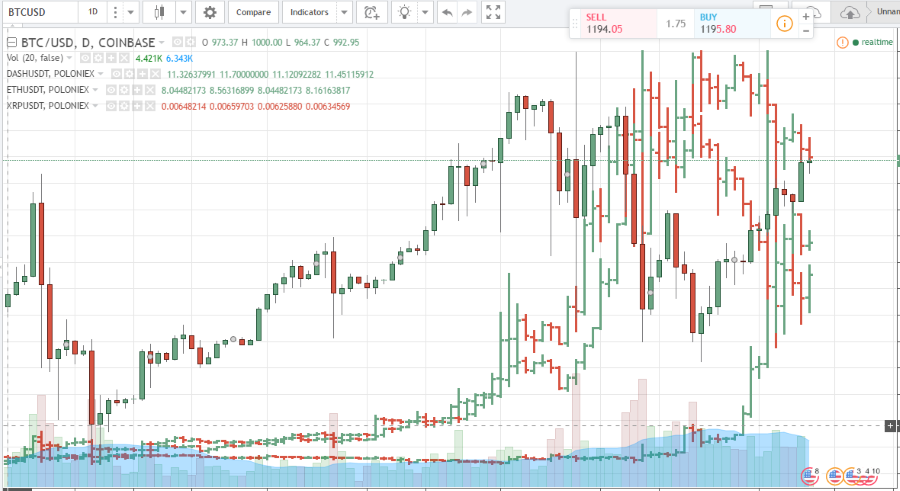

To get the prices, we grabbed a chart from TradingView.com – our first-ever visit to the site, which is bloody easy to use, we might add – and use their figures for open price on January 1.

So there we are, a simple portfolio with four of the biggest crypto assets. But…how did it perform?

Quadruple. Your. Money.

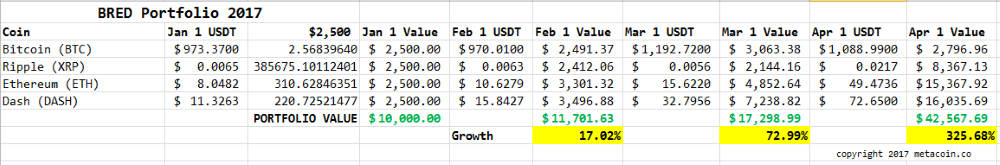

What will remain to be seen here is whether or not this is an aberration – past performance not indicative of future results and all that.

But holy buckets this thing is on fire.

$10,000 invested equally on January 1 in four cryptocurrencies – Bitcoin, Ripple, Ethereum, and Dash – would have grown to $42,567.69 on April 1.

So…Now What, Smart Guy?

Yes, hindsight is 20/20. Looking back, the woulda-shoulda-coulda factor with the coins that aren’t named Bitcoin is pretty huge. And the volatility is such that today’s number on the BRED portfolio is more like $44,000 – and that’s due in part to the Ripple developments over the weekend.

But here’s our take – and we’re not investment professionals, nor do we provide legal advice – on what to do with this information:

Buy and hold. It doesn’t have to be these four cryptocurrencies, but you should consider having a few coins or tokens that you simply leave alone. Don’t trade them, keep them in cold storage, and worry about them only a little.

“Love me a good manifesto.” Actually, we’re struck by how many altcoins HAVE manifestos – and why they feel the need AND they choose the word “manifesto” in the first place.

“Love me a good manifesto.” Actually, we’re struck by how many altcoins HAVE manifestos – and why they feel the need AND they choose the word “manifesto” in the first place.

Only three cryptocurrencies now own a market cap of $1B (USD) or higher:

Only three cryptocurrencies now own a market cap of $1B (USD) or higher:  (So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.)

(So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.) Rates start at 7.7% and you can have your money in as little as five days.

Rates start at 7.7% and you can have your money in as little as five days.

If you follow the cryptocurrency space, you might have noticed some wild growth from an altcoin called

If you follow the cryptocurrency space, you might have noticed some wild growth from an altcoin called  So, generally speaking, it’s just like all the other coins – same concept as

So, generally speaking, it’s just like all the other coins – same concept as

Saying it might mean good things for Dash, its users, and investors might be the understatement of the decade. You have a strong community, coupled with the infrastructure build to support use in the mainstream economy. And you have people like Amanda (really, we’re just scratching the surface, as there’s a whole host of people talking up Dash out there) stumping on the currency’s behalf.

Saying it might mean good things for Dash, its users, and investors might be the understatement of the decade. You have a strong community, coupled with the infrastructure build to support use in the mainstream economy. And you have people like Amanda (really, we’re just scratching the surface, as there’s a whole host of people talking up Dash out there) stumping on the currency’s behalf.