People of Earth,

It’s been a really interesting few days in the Crypto universe, culminating with a glorious morning of some staggering gains.

Behold the Top 7 coins, screengrabbed a bit ago from CoinMarketCap.com.

Numbers like these provide nice bold lettering to the HODL crowd, and the ones who say I never left Bitcoin, and the OGs who bought at a buck a piece.

And, you know what, they could actually be evidence of a comeback.

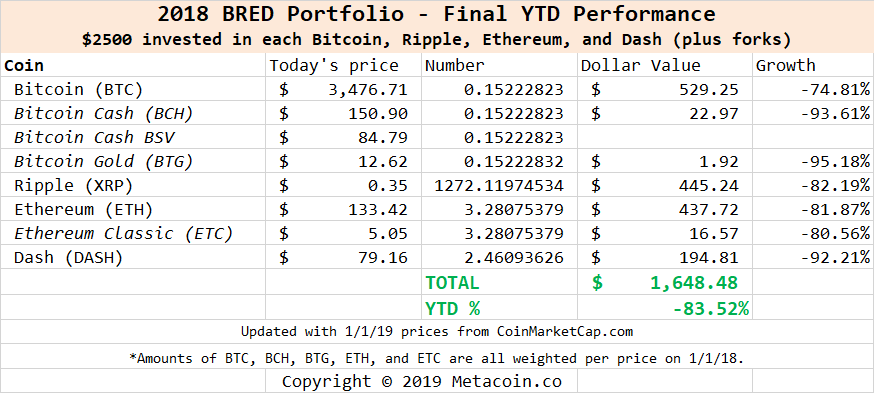

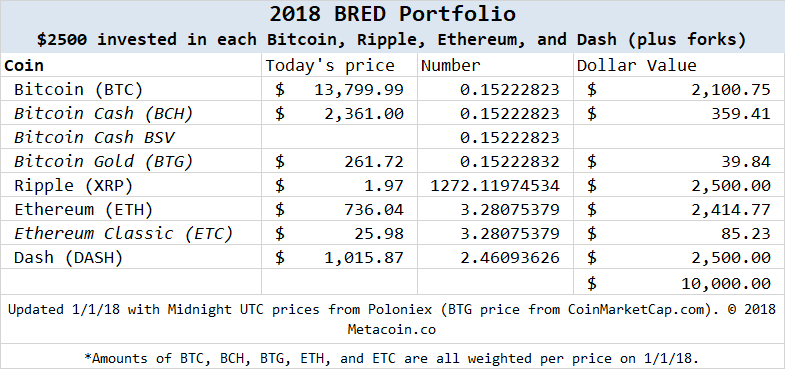

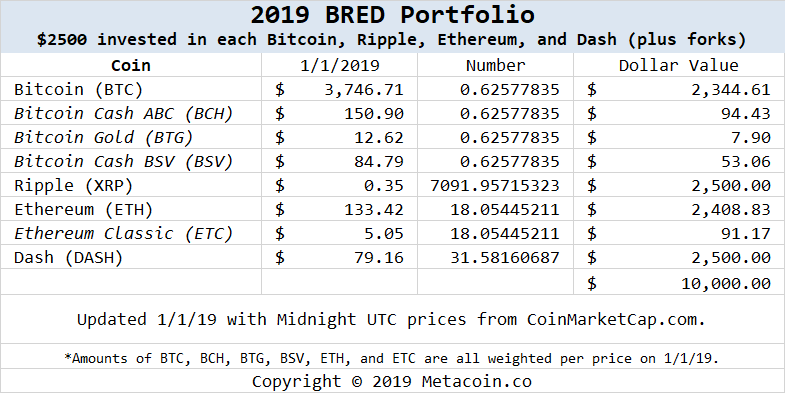

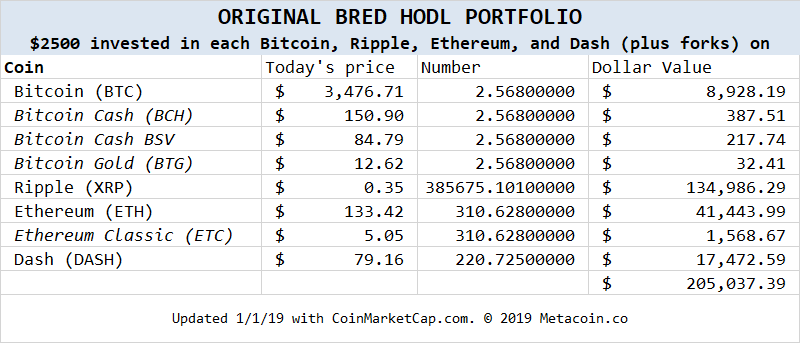

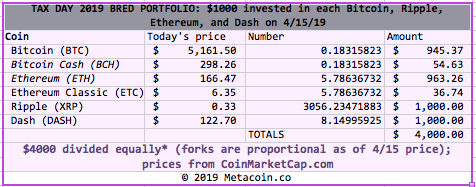

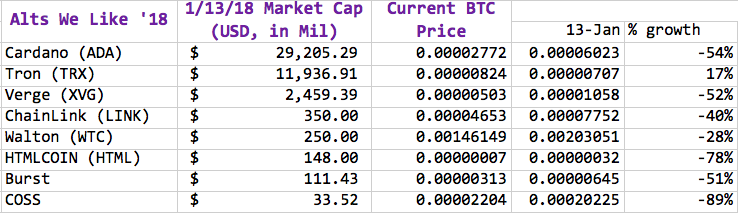

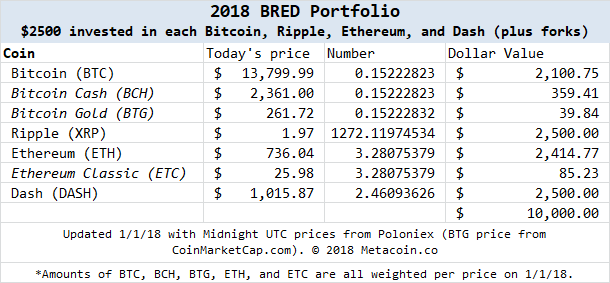

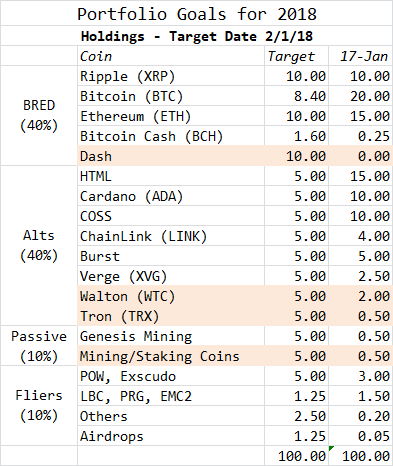

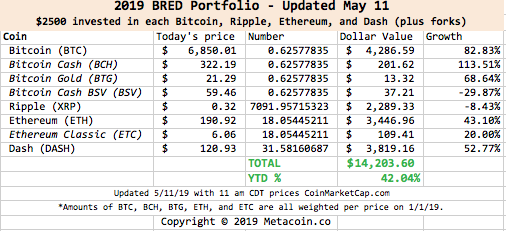

If you’re familiar with our BRED portfolio, first introduced in the Bull Run of 2017, you know that this was ONE WAY to possibly hedge your bets. And a lot of the “hedging” success you may have had could have depended on a few factors — such as when you decided to invest, or where you are in your own financial journey, or even whether or not you needed actual money to pay actual bills.

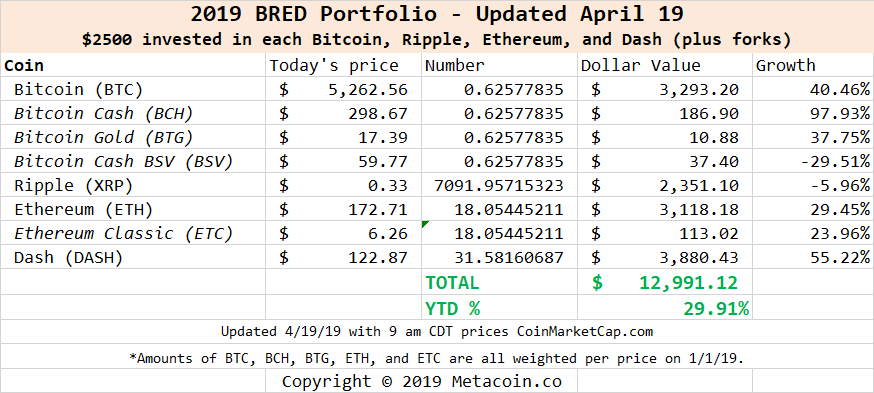

If you’ve watched this space over the past few weeks, you know that we went back down the BRED rabbit hole again in April, and, at that time, we saw that the growth was about 29 percent. This does not a bad year make.

If you had decided on January 1 (hypothetically) to get back into the BRED portfolio again, you would be up 42 percent today.

However, Does a Nice Week (Or Two, or Six) Mean a Comeback?

That depends.

BREAK TIME: HERE’S A COINBASE LINK, AND THIS IS AN AFFILIATE LINK SO WE’RE BEING AS BLATANT AS POSSIBLE THAT WE CAN MAKE A FEW BUCKS OFF OF IT.

Bitcoin’s price on January 1 was $3476.71. This morning’s price was $6850.01. That’s an 82 percent pop in a little over four months.

But there are also some headwinds: the Tether legal troubles (which are just beginning) and the Binance hack (which the coin may have recovered from) are two pieces that might give you pause.

What to Do…What to Do…

Well, since we may be like you — skeptical, sure, but excited that the comeback ***might*** be underway, how bout some old, tried and true wisdom?

- Do Your Own Research. Yes, that’s right, we can’t take responsibility for how much or how little you make or lose. We’re just here to provide some information. Act on your own investments with some diligence, okay?

- Don’t Invest More Than You Can Afford to Lose. Duh.

- If You’re In a “Friendly” Country, Consider Taking Advantage of That. Our buddy @BambouClub on Twitter is an expert on this sort of thing. We’re Americans, so we can’t do a ton of things you foreigners can.

- Consider Other “Hedges.” For instance, we’ve talked about our love for this Non-Fungible Token movement, and specifically games like MegaCryptoPolis. (REFERRAL LINKS IN THAT ARTICLE.) That’s at least one way to spread out your risk.

What Happens Now?

Darn good question. A LONG WAY TO GO if we’re looking to get back to the $20,000 BTC level.

But the signs are good lately.