Quick post here, because most pundits will, IMHO, “Bury the Lead.”

(If you’re not familiar with that concept – “burying the lead” involves talking about everything but the biggest news first. Sorta like…”Hey, how ya doin? Did you hear that it’s supposed to rain today? Yeah, it’s been kinda cold, too. My dog is tired. The kids are okay. By the way, I won the lottery last night and now have a million dollars! Talk to you later.”)

And all the pundits will say “OMG, Bitcoin got up to $2000!” Which is great. A worthy accomplishment.

But, IMHO, the worthier accomplishment – and the “LEAD” in this story, is this: Ethereum is up to $120.

Ethereum All-Time High: Biggest News of the Week

Why?

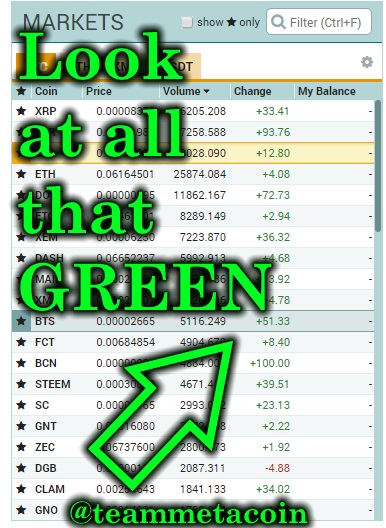

- Support over $100/coin. This is rather big, since ETH went over that figure overnight, stayed over that figure this morning and into the afternoon, and now leads Poloniex in volume (on the BTC-pairs portion of the exchange; screenshot above).

- Ethereum is the business story – maybe moreso than Ripple. Yes, the XRP love was shown this week, and a pullback into the 17000-Satoshi range wasn’t unexpected. But where the action is going to be is not necessarily in payment processing and transactions between banks (which, don’t get me wrong, is vitally important), but in using Ethereum’s “smart contracts” to underpin just about every sort of insurance, banking, legal, and other kind of contract in the world.

- That was a bold statement – and it’s one we talked about a little here. The ETH coin underneath the Ethereum technology has the potential to be more earth-shattering than Bitcoin itself, and more earth-shattering than Ripple’s XRP for sure.

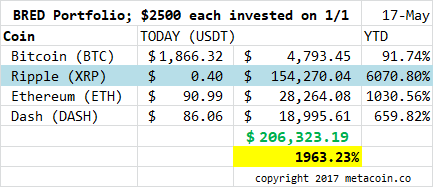

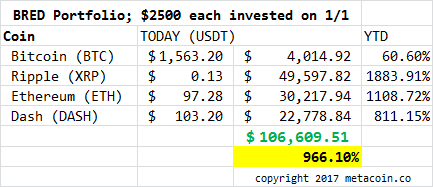

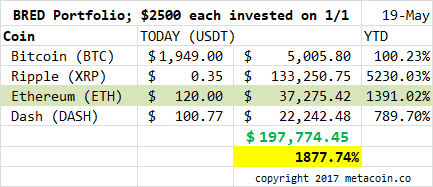

And an ETH Investment YTD…

Here’s this afternoon’s BRED Portfolio chart. Sure, it’s no XRP, but your ETH investment would be would be A-OK.

Here’s this afternoon’s BRED Portfolio chart. Sure, it’s no XRP, but your ETH investment would be would be A-OK.

OMG.

Happy trading!

BTW, if you haven’t gotten started with Bitcoin, Ethereum, or Litecoin yet, use this AFFILIATE link to check out Coinbase. You’ll get a $10 bonus (well, $10 worth of BTC) with your $100 purchase of any of the three coins. And we’ll get a $10 bonus for referring you.