Following a little on the theme from a couple days back — and you can see it here where we talk about the investor dude’s 5 Coins to 5 Million project — we’ve decided to start analyzing coins you can actually purchase (if you’re an American) on Crypto.com. (THAT IS AN AFFILIATE LINK; we may be compensated if you open up an account there.)

A couple reasons for going this route:

- If you’re new to crypto — as many are — you might not be ready to go through a laundry list of steps to access the coins that *could* pop;

- You’re not getting into this to “flip” coins or day trade (95% of the visitors to THIS SITE, at least, are ones who are less interested in trying to get in and out of coins and more interested in long-term strategies like the ones you can read in last year’s popular post: Playing the Long Game);

- You DON’T WANT TO MESS WITH THE LAW.

That third piece is really important: you do not want to get into the business of investing in a foreign-domiciled altcoin that could be hunted down by the US SEC. You want to use companies that have been blessed in the US and have projects in their platforms that are okay with American regulators.

Only two ways to do this: Crypto.com (AFFILIATE LINK AGAIN) and Coinbase (ALSO AN AFFILIATE LINK).

We’ve decided to study this in a few parts; today, we present a deeper dive into three of the coins that you could, conceivably, buy right now.

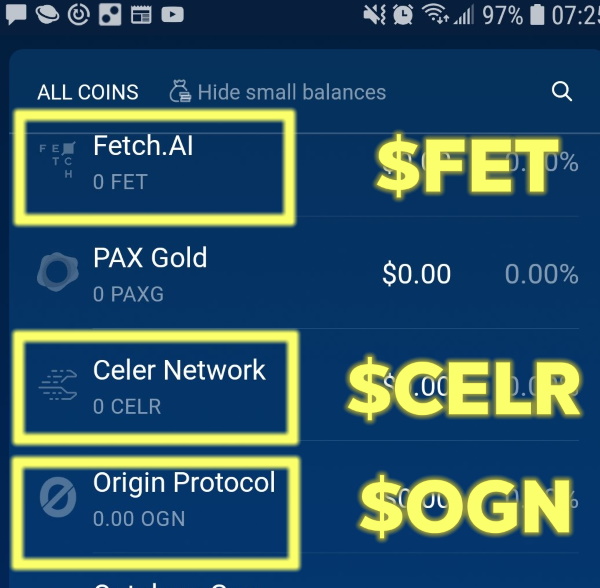

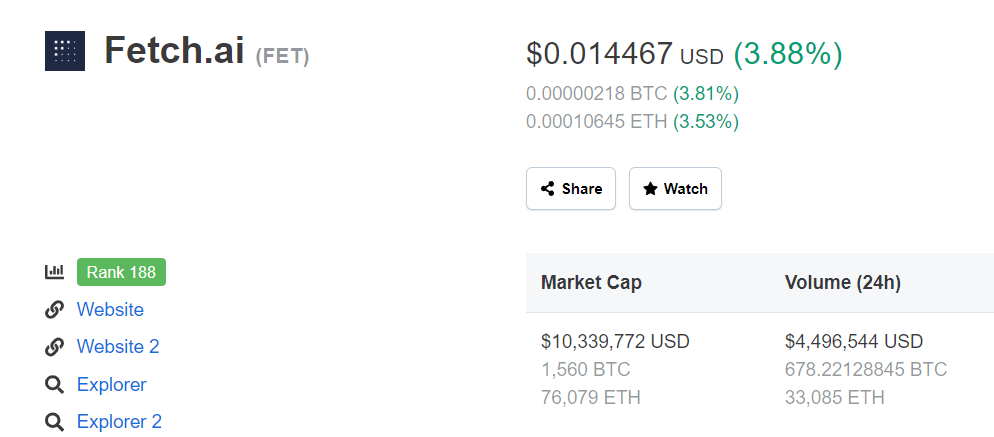

1. Fetch — $FET — Possible Low Market Cap Gem

Fetch sounds really compelling, especially in light of everything that is happening in the world. One of the use cases is the type of thing that we’ll hear about as manufacturing either shifts toward making ventilators, or ramps back up when the auto and aircraft manufacturers start making their products again:

In the video (which you can watch below) the CEO talks about a consortium of steel mills that are already using the platform. More discussion is on the “Use Case” page of the Fetch website.

The market stats for Fetch are definitely in line with what the 5-coin guru says: low market cap, really good use case, could take off.

Tease this out as a potential unicorn for a second: if its market cap goes from here to $1B, that is a possible 96x from here. AGAIN, DO YOUR OWN RESEARCH.

2. Celer Network — $CELR — eSports Platform on a Blockchain

Actually, that subhead to describe Celer probably could be a cocktail napkin pitch. “Hey, let’s power eSports, but do it on a blockchain!”

If eSports turns into a larger industry than it currently is — and, in 2020, with people not leaving their homes, the odds are it very well might do just that — CELR is on the cusp of something huge.

Applying the stupid-simple “Potential Unicorn Math Process” (also known as “PUMP” because you need to be wary that any of these could explode AND then dump just as quickly), you could potentially go 169x with your money.

(Also time for us to repost our DYOR sign: Do Your Own Research.)

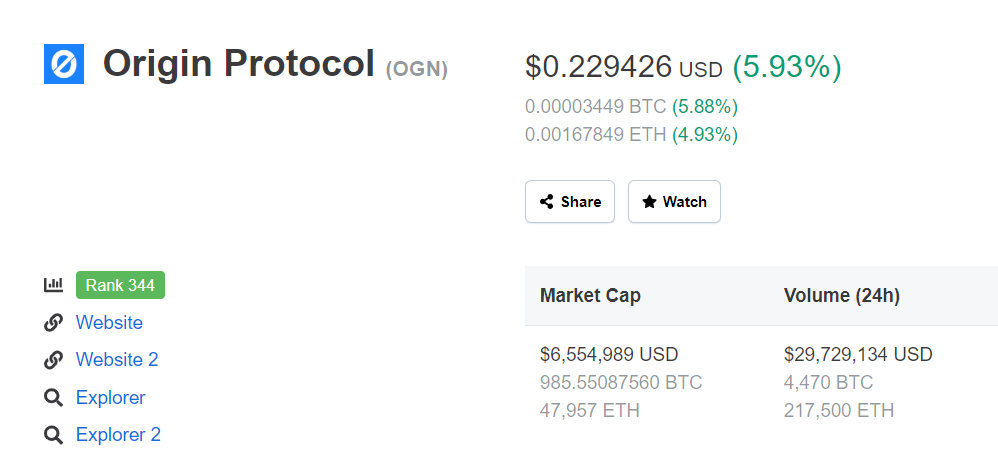

3. Origin Protocol — $OGN — “The Blockchain Platform for Building Decentralized Marketplaces”

If the future will be decentralized, a bet on Origin could turn out to be a smart one.

Origin is betting that (1) people will start (or continue) hating on existing peer-to-peer platforms like Uber and Airbnb and (2) the growth of peer-to-peer marketplaces will be decentralized.

This looks like it could be a really wise bet.

Using the PUMP metric, you could go 155x your money if this project goes Unicorn from here.

More Caveats

We’re not telling you to run out and spend hard-earned cash on these projects. You need to Do Your Own Research (there’s that acronym again) and don’t get in over your head.

But, to the extent that you want to take a chance on a coin that could pop, or you have extra cash sitting in a drawer that could be put to use, an investment in any one of these could — again COULD — potentially pay off.

Good luck.

Leave a Reply