EDITOR’S NOTE: June 23 – 2:51 pm – It has been pointed out by a kind soul that original investors of the ICO could have bought at 0.01 ETH – meaning a price of around $3.20 per Bancor token. Thus, even though Coinmarketcap.com lists a price for a week of around $20 per coin, the ICO investors are still in good shape.

The original premise, though, is one I’ll stick with – lockup might do some of these overhyped ICOs a bit of good.

The rest of the text remains unchanged.

If you’ve been watching this space for more than a few weeks, you know that there’s a good chunk of “froth” in the ICO (Initial Coin Offering) market. That froth was on display recently – JUST LAST WEEK – when Bancor launched its ICO and sold some crazy amount of Ethereum in a matter of moments. Read more here from NewsBTC.

And if you’ve been around the financial world for any amount of time, you know how IPOs (Initial Public Offerings) work – a heck of a lot differently, and the pricing is almost always done in a matter that, while shutting out the little guy initially, enables the price to be somewhat stable over the short- and medium-term.

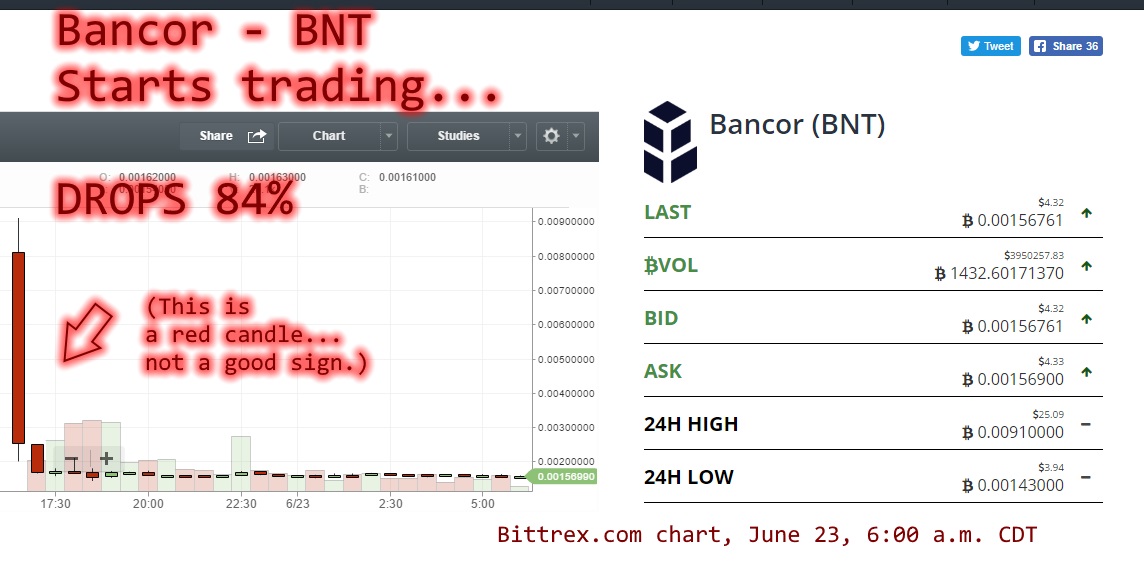

Well, as of this morning, Bancor is back in the news – and it’s not for a good reason. Their tokens are already trading on the open market – and here’s a screenshot from Bittrex that might scare the heck out of you.

We’ve Entered New Territory

That’s right – we have now gone where no token has gone before – from the biggest ICO ever to the most precipitous drop in recent memory.

If you judge market cap based on ICO value alone, i.e. they raised $153m, and their price when they “went public” was $20/token, that means 7.65 million tokens in the ICO (pardon my math, I know there are a lot more variables here, such as how many coins are held by the company, locked up, used to stabilize the network, etc.).

This would also mean that the ICO value went from $153m to roughly $30.6m – given the price of $4.20 a share that CoinMarketCap.com has it trading at.

No matter how you slice it – this is not good for Bancor.

Why Lockup is So Vital

If you’ve ever been part of an IPO, you know there are tons of rules in place governing the sales of shares. In an IPO, there’s always a quiet period before shares are sold. Investment banks and market makers negotiate behind the scenes to ensure that the price and number of shares will meet market demand just enough so that it’s not over- or under-subscribed.

Then, once the shares go live, those who hold them – from executives on down to rank-and-file employees – have their shares locked up. They can’t buy, sell, trade, or any of that for what is usually a 90-day period.

The goal is to encourage some stability in the marketplace: if an executive of a company that went public decided to cash in immediately, what would that say about the confidence the executive has in the company? What would that do to the stock price?

Lockup is the most vital tool in the ICO toolkit.

That’s right – are you better off raising $153 million and then seeing the value drop like a stone once it trades? Or raising, say, $30 million, holding the coins for 90 days, and weeding out those who are just looking to dump and get out for the quick buck?

What’s Next?

We’ll have to watch the market and see what happens to Bancor. Does it rebound? Do tokenholders revolt? Is this the one that causes the SEC to weigh in on this new way of raising capital?

In any event, food for thought – overhype your ICO, then don’t lock up the tokens, and you might have a recipe for disaster.

Leave a Reply