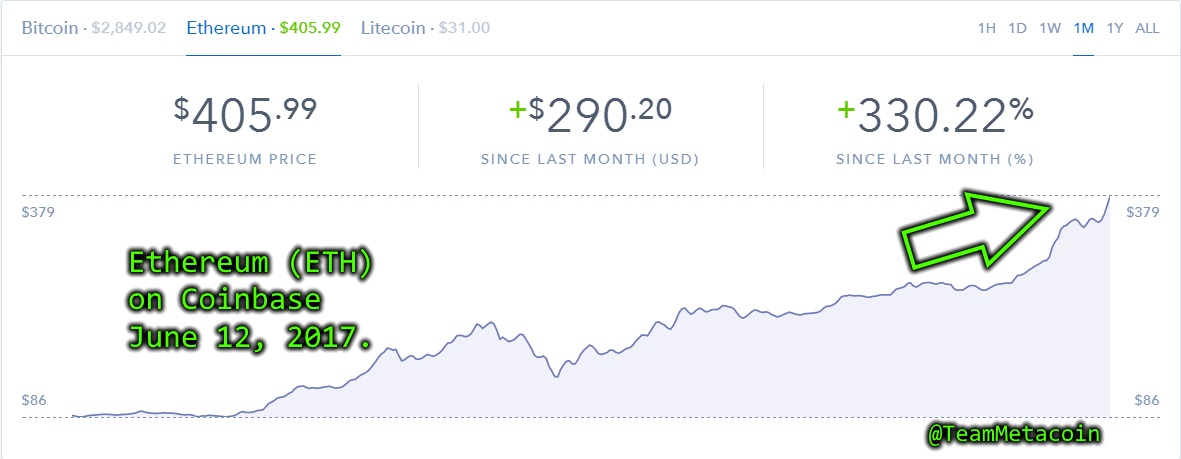

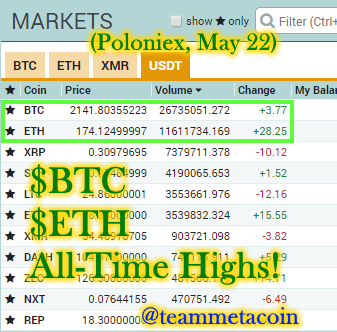

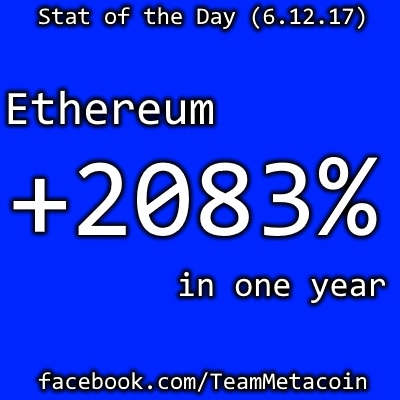

How crazy is this space? How quickly does it change? Well, for starters, we were up way too early AND worked on a post about Ethereum hitting all-time highs. THEN IT BROKE THROUGH THE $400 BARRIER.

Ethereum = Fire.

Or do we say “straight-up fire?” Any way you slice it, Ethereum is looking like a rocket these days. And it’s a head-scratcher, too: why? Can it be sustained? Should you get some at this price because next thing you know it’ll be $1000 – then $3000?

Or do we say “straight-up fire?” Any way you slice it, Ethereum is looking like a rocket these days. And it’s a head-scratcher, too: why? Can it be sustained? Should you get some at this price because next thing you know it’ll be $1000 – then $3000?

Here’s the screenshot and graphic thingy that we whipped up…right before the $400 level.

This is starting to look seriously crazy. And perhaps unsustainable. Still…

Flippening?

This is a term that you might not have heard yet – especially if you’re new to cryptocurrency. In brief, Bitcoin is the market cap leader, and Ethereum is second. Flippening refers to the moment when the two flip places.

SPONSOR BREAK: IF you are new…get yourself some coins – Ethereum, Bitcoin, or Litecoin – through this link at Coinbase. You’ll get a bonus, we’ll get a bonus (with qualifying purchase); but, most importantly, you will be in the game and not on the sidelines. You can start with a tiny amount if you’d like. Now, back to the post.

Flippening is being tracked here. It used to be a pie-in-the-sky idea: hey, Ethereum COULD be bigger than Bitcoin. Then, it started to become a real possibility. Now, at 70+%, could it happen this year? THIS SUMMER?

Post-Flippening Idea Number 1

This could end up being much ado about nothing, and that’s our first Post-Flippening idea. Let’s say it does happen, and it happens this year. There’s a little weeping, gnashing of teeth for a while, and maybe there’s UASF and hard fork and Segwit discussions that are over the heads of mere mortals like me.

Post-Flippening Idea (PFI) Number 1: ExxonMobil vs. PetroChina. (WHAT? I’ll explain.) In the 2000s, the largest company by market cap seemed to flip-flop: it was ExxonMobil, then it was PetroChina. Back and forth they went. No biggie.

The world may be big enough for two large players, and Bitcoin and Ethereum each have their own role in this world. This could happen. Pretty feasible.

The question is: which one is ExxonMobil and which one is PetroChina?

Post-Flippening Idea Number 2

Apple. One of these two is Apple.

Once Apple took over as the top company in the world by market cap in the third quarter of 2011, they gave up that spot in only two quarters that followed. Nineteen out of twenty-one quarters had Apple in the top spot.

Apple has been number one since the third quarter of 2013, and it shows no signs of relinquishing that spot.

Is it possible that…well, that Ethereum is ExxonMobil (the only other company since Q3 ’11 to be number 1) and Bitcoin is Apple? I mean, really, Bitcoin IS the dominant coin, it was first to market, and it shows no signs of slowing either.

Or is it possible that Ethereum is Apple, will take the throne, then give it up, then take it back…and not look back?

Only certainty: rapid changes.

Since we started typing this post – a span of about 20 minutes – the price has fluctuated from $380 to $408.12 on Poloniex, and now back down to $382.

Volatility is certain. The Flippening? Not sure about that one.