Several outlets, including Tech Crunch and Coindesk, are reporting that users of the popular Coinbase digital wallet and currency trading site can now buy and sell Litecoin.

Coinbase confirms this is the case on its own blog, and you can read the Coinbase blog post here: Coinbase Litecoin.

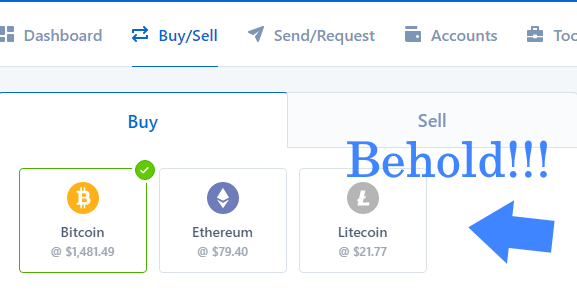

And, when we visited our own Coinbase dashboard…there it was, in all its glory:

Coinbase started in July of 2012, adding Bitcoin support shortly after it launched, then extending its platform to include Ethereum this past July. Funny enough, we just asked THIS MORNING, in our blog post on a coin you should consider adding to your portfolio, when a new coin was coming to the platform.

So now is as good a time as ever, right? That is, get yourself a Coinbase account and use this link and, with qualifying purchase, you’ll get a bonus. And we’ll get a bonus. It’s that win/win we’ve talked about.

Did we mention Segwit above? We did. Here’s a link to the latest on

Did we mention Segwit above? We did. Here’s a link to the latest on  Didn’t see THAT one coming, did ya?

Didn’t see THAT one coming, did ya?